Japan’s Government Pension Investment Fund (GPIF) and Dutch pension investor APG, have launched a joint investment program to gain access to attractive investment opportunities, with a focus on infrastructure in developed overseas markets.

This marks the first time that GPIF and APG, on behalf of Dutch public pension fund ABP, as its majority shareholder, have joined forces. This collaboration brings together two of the world’s leading pension investors, with a combined total assets under management of over €2 trillion.

The partnership will focus on investment opportunities that align with the long-term strategies of both pension funds to drive long-term value for their respective beneficiaries.

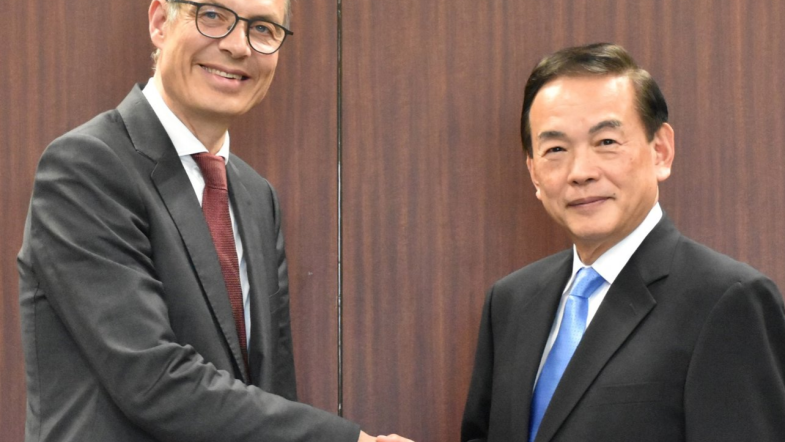

“GPIF has been increasing exposure to alternative investments (infrastructure, private equity, and real estate) in expectation of greater portfolio diversification, seeking to improve investment efficiency and further ensure the stability of pension finance. As part of our recent partnership with APG, we launched a joint investment program in the infrastructure sector. As the leading public pension fund in each country, we are pleased to be at the start of a long-term partnership with APG. GPIF will continue to work to secure long-term investment returns for the benefit of the pension beneficiaries,” said Masataka Miyazono, President of GPIF.

“We are delighted to partner with GPIF, as our shared commitment to long-term private investments makes this collaboration a natural fit. We believe that joining forces will help to address the growing need for coordinated actions from like-minded, long-term investors to deliver long-term value to our beneficiaries and the broader society. We look forward to collaborating with GPIF to achieve our shared goals,” said Ronald Wuijster, CEO of APG Asset Management.

ABP

ABP is een BPFv met eind Q4 2023 een belegd vermogen van € 500.385 miljoen waarvan 0% herverzekerd en 0% voor risico deelnemer.

Het fonds heeft een deelnemersbestand met in 2022 1.232.782 actieve bijdragers en 997.317 pensioengerechtigden. De beleggingen voor risico pensioenfonds hadden in Q4 2023 een rendement van 9%.

Eind Q4 2023 had het fonds een beleidsdekkingsgraad van 113.9% terwijl de vereiste dekkingsgraad op dat moment 126.3% bedroeg. De fiduciair manager van het fonds is APG en de pensioenadministratie wordt uitgevoerd door APG.