Despite challenging headwinds, investors remain committed to thematic investing1 with the percentage of those currently investing or planning to invest increasing since 2020, according to the third Thematics Barometer published by BNP Paribas Asset Management (‘BNPP AM’) and BNP Paribas CIB (Corporate & Institutional Banking), in partnership with Coalition Greenwich.

For its third edition, the thematic investing research report covers almost 200 institutional investors and intermediary distributors in Europe, Asia and North America. The survey aims to provide the global investment community with robust, credible and regular information about the key trends evolving within thematic investment.

Key findings of the latest survey include:

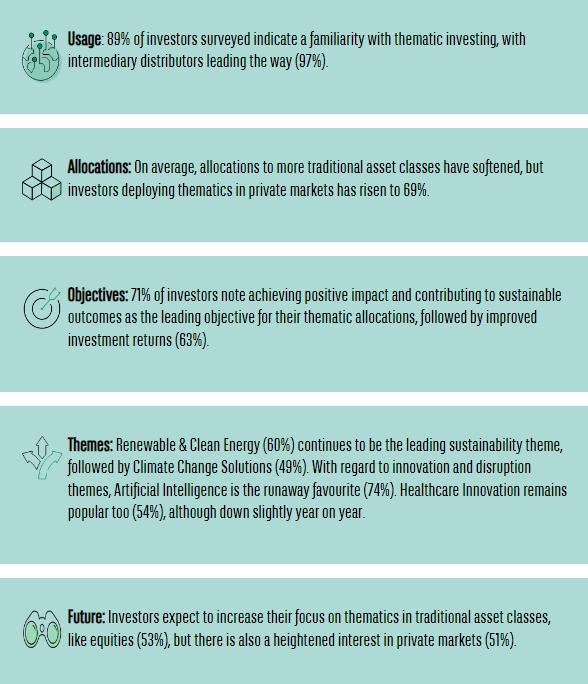

- A vast majority of respondents (89%) are familiar with thematic investing, its adoption, however, is more nuanced, as institutional investors show increased interest (+10%) with further plans to invest, whereas intermediaries note a slight decrease in current usage (-4%). European investors lead the way and show an increase in adoption of thematic investing from 46% to 61% since 2020.

- Equity allocation remains the preferred asset class, but investors developing thematic offering in private markets has risen 11% vs 2023, buoyed by interest from institutions. Likewise, thematics investors largely prefer a global perspective when selecting a thematic strategy in traditional asset classes, whereas in private markets, they note a preference for a more regional point of view.

- For nearly two thirds of investors, achieving positive impact and contributing to sustainable outcomes is the leading objective for their thematic allocations, followed by improved investment returns (63%). An innovative and disruptive approach to thematic investing (43%) is also a growing trend driven by a strong interest in artificial intelligence.

- Renewable & Clean Energy continues to be the leading sustainability theme in demand (56% to 60%), pulling focus away from most other categories. Regarding innovation and disruption themes, Artificial Intelligence is the favourite (74%) followed by healthcare innovation.

Renewable energies and mobility driving sustainability themes

Achieving a positive impact and contributing to sustainable outcomes is the main overall objective in using thematic investing, with enhancing investment returns the second most important objective. Interest in Renewable & Clean Energy continues to grow (+15% since 2020), while the focus on SDGs continues to slip. APAC is the region most interested in renewable energy, while Europe focuses more on climate change.

Net Zero, Demographics & Health and well-being remain stable topics of interest (20%), broadly balanced between Intermediaries and Institutions, while Water, remains popular, ranked higher in Europe with an increasing interest from distributors (29% in 2023 to 38% in 2024) .Adaptation and Resilience were added as new themes of interest this year given their increased inter-relation to other ESG themes including physical climate risk.

Mobility is a growing interest growing globally (6% in 2023 to 11% in 2024, almost doubled), highly supported in North America. And while Diversity & Equality appeal decline globally, it remains an area of internet in North America.

AI and healthcare lead the Innovation & Disruption themes

Artificial intelligence is by far the favourite topic (74%) regarding most appealing Innovation and disruption themes for portfolios, followed by Healthcare Innovation (54%), although down slightly year on year. North America shows a strong interest in Biotech while Asia had the higher preference for Robotics amongst all respondents.

Asset allocation to thematic investing: the rise of private markets

Target growth areas for thematic investing are expected in most asset classes and regions –but in Asia for equity investing and Private Markets. Indeed, active equities remain the assets most invested in thematic strategies, but private markets also make up a considerable share of allocations to thematics (+11% from 2023) as nearly 60% of institutional investors plan to increase focus on this asset class while investing in thematics.

Pieter Oyens, Global Chief Marketing Officer at BNPP AM, comments: “With the increasing pace of change in the economy, investors have told us in this survey that they continue to commit capital to thematic investments driven by the search for impact and investment returns. Thematic investments provide an alternative to traditional strategies and are a compelling way for investors to align portfolios with the trends shaping the future.”

Constance Chalchat, Chief Sustainability Officer, BNP Paribas CIB and Global Markets, comments: “The results demonstrate how investors continue to be increasingly interested in sustainability thematics. The ongoing thematic focus of investors on renewables and clean energy, alongside an evolving interest in resilience, water, adaptation, AI and demographics in this years’ survey, highlights the importance investors place on these issues. The opportunities these themes present as a performance driver also provide important insights on the investment horizon ahead. “

BNPP AM and BNP Paribas CIB jointly sponsored the Thematics Barometer. It was conducted by Coalition Greenwich, who interviewed 180 institutional investors and intermediary distributors between April and June 2024. The previous survey was conducted in 2020 in Europe and Asia but excluded North America.

Highlights Thematic Barometer 2024