In this article the 10 largest Swiss pension funds will be examined. But to give some nuance, we give a brief overview of both the Swiss pension market and the Swiss pension system.

In this article:

According to Swiss Confederation Federal Statistical Office (FSO) or Confédération Suisse , the total asset under management in the Swiss pension market was valued around CHF 1.159 trillion as of 2021 , making the Swiss pension market the 3rd largest pension market in Europe. According to the Confédération Suisse, the Swiss pension market consists of approximately 1400 pension funds in 2021. In 2021, 1389 pension funds generated a net return on investments of CHF 87 billion. The Confédération Suisse also stated that as of 2021 there are around 4.5 million active pension members in Switzerland.

Swiss pension system

Confédération Suisse states that the Swiss pension system consists of three pillars that collectively provide retirement provisions for individuals. The first pillar is the state pension, known as the Old Age and Survivor’s Insurance (OASI). It is designed to cover basic needs in retirement and is financed through social security contributions. The minimum and maximum monthly pensions currently stand at CHF 1,225 and CHF 2,450, respectively. The amount of the pension depends on factors such as the number of years of OASI contributions and the individual’s average annual income.

The retirement age for women is 64 and for men is 65, but early or postponed retirement options are available. Early retirement results in a reduced pension, with a 6.8% reduction for one year of early retirement and a 13.6% reduction for two years. Postponing retirement can increase the pension based on the additional years of work beyond the retirement age.

The second pillar of the Swiss pension system is the occupational pension, which is calculated based on contributions made during the individual’s working life and the regulations of the specific pension fund. Upon retirement, a monthly pension is received based on the accumulated capital. Pension funds offer different payout options, such as a lump sum and monthly pension combinations. The conversion rate, currently set at a minimum of 6.8%, is applied to determine the annuity for life.

Early or postponed retirement options are available within the second pillar as well, subject to the regulations of the pension fund. Early retirement may result in a reduced pension, while postponed retirement increases the conversion rate and subsequently the pension amount.

The third pillar of the Swiss pension system is voluntary and involves individual retirement savings. Contributions to a third pillar account increase total retirement savings. The accumulated capital can generally be withdrawn in one lump sum, with specific withdrawal options and conditions varying among financial institutions.

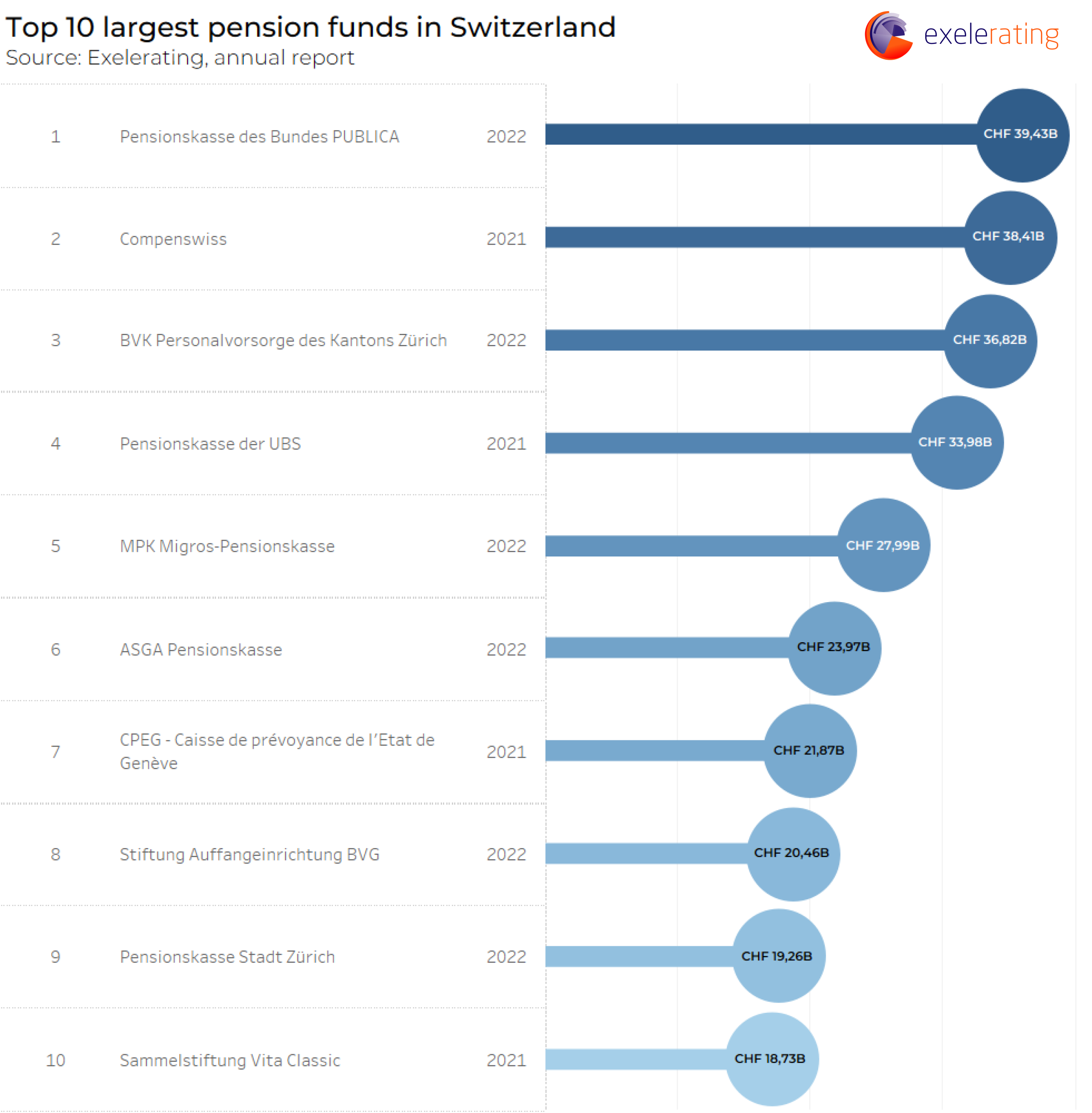

Now we will focus on the top 10 biggest pension funds in Switzerland. We will examine their assets under management, pension membership and fund type. Furthermore, we will examine the asset allocation strategies of these pension funds, providing valuable insights into their investment portfolios.

Top 10 largest pension funds

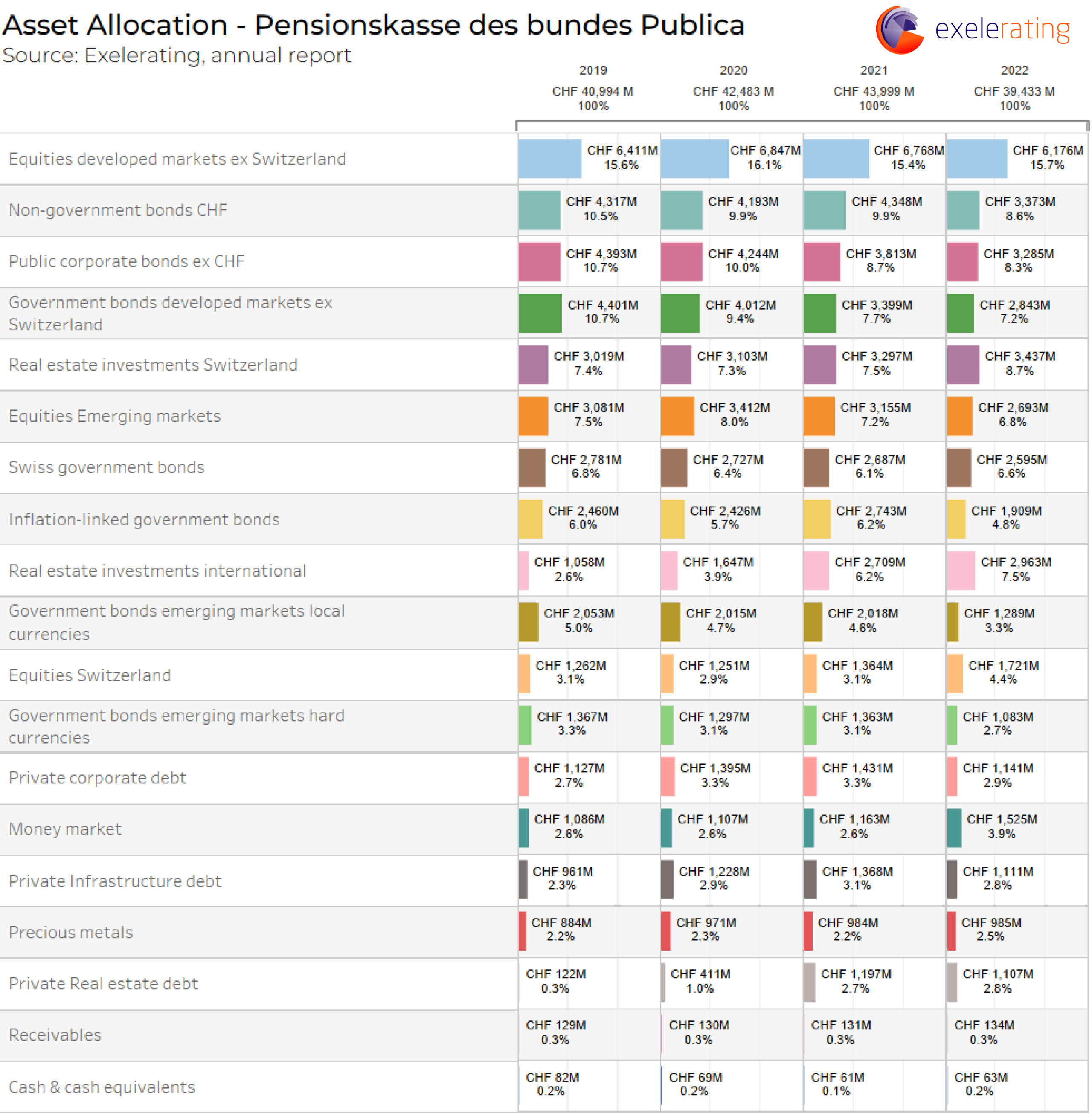

1. Pensionskasse des Bundes Publica – CHF 39.43 billion

Pensionskasse des bundes Publica is the largest pension fund in Switzerland, with CHF 39.43 billion in assets under management (AUM) as of December 2022.

The Pensionskasse des Bundes Publica is a defined benefit pension scheme that provides retirement benefits to employees of the federal administration, the Federal Council, and certain affiliated organizations. It operates as a mandatory occupational pension plan, which means that eligible employees are required to participate in the scheme.

Pensionskasse des Bundes Publica has approximately 68,000 active members and invests in a diversified portfolio of assets, including equities emerging markets, Swiss government bonds and precious metals. The pension fund has C-alm and ORTEC fulfilling the role of ALM Consultant.

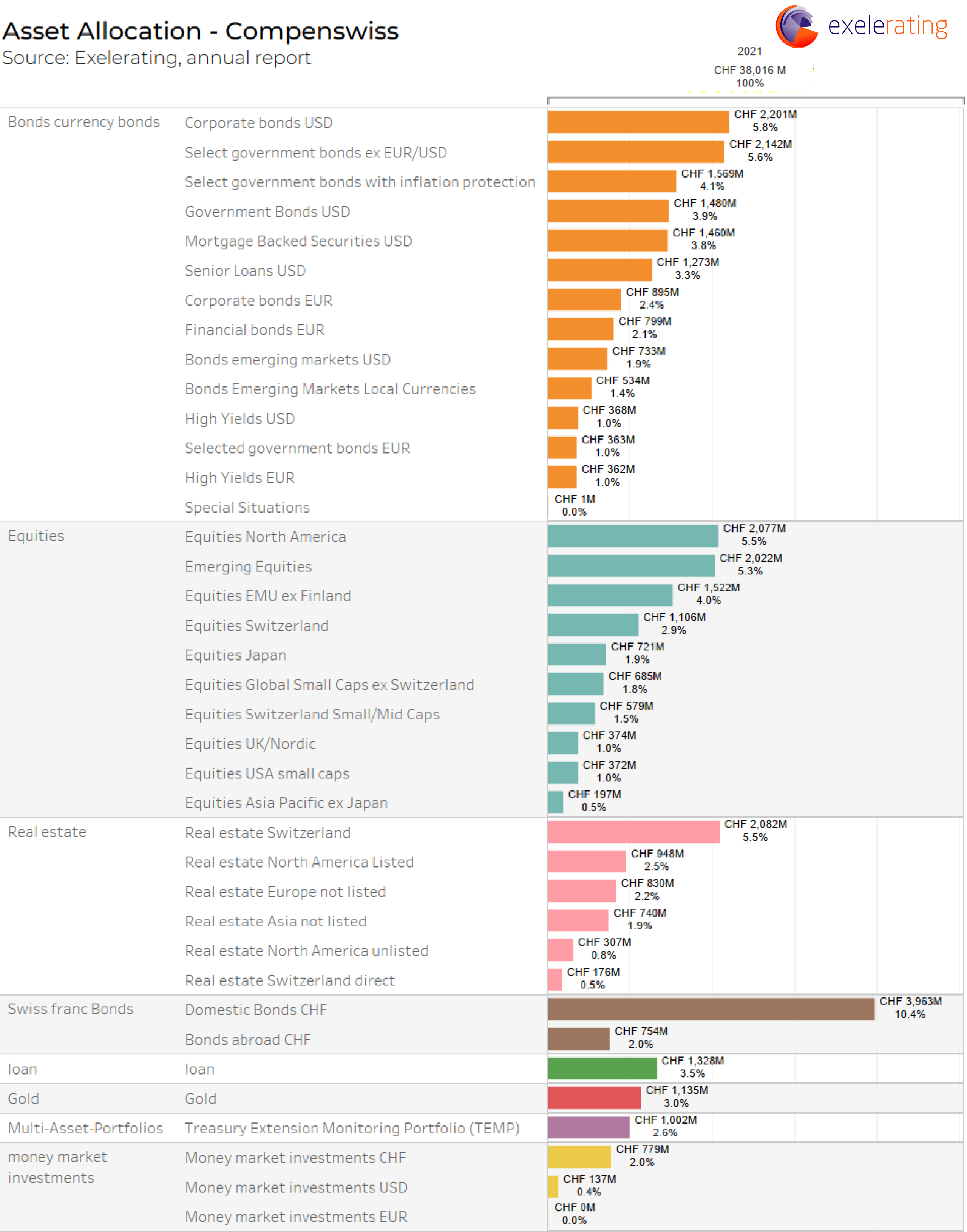

2. Compenswiss – CHF 38.41 billion

Compenswiss is the second-largest pension fund in Switzerland, with CHF 38.41 billion in assets under management (AUM) as of December 2021.

Compenswiss is the Swiss Federal Social Security Funds, also known as “Die Ausgleichskasse/Compenswiss” in German. It is a federal pension fund responsible for administering and managing various social security programs in Switzerland.

Compenswiss operates as a public pension fund and invests in assets like equities (North America, Japan, Switzerland), property, gold and bonds like corporate bonds (USD/EUR).

3. BVK Personalvorsorge des Kantons Zürich- CHF 36.82 billion

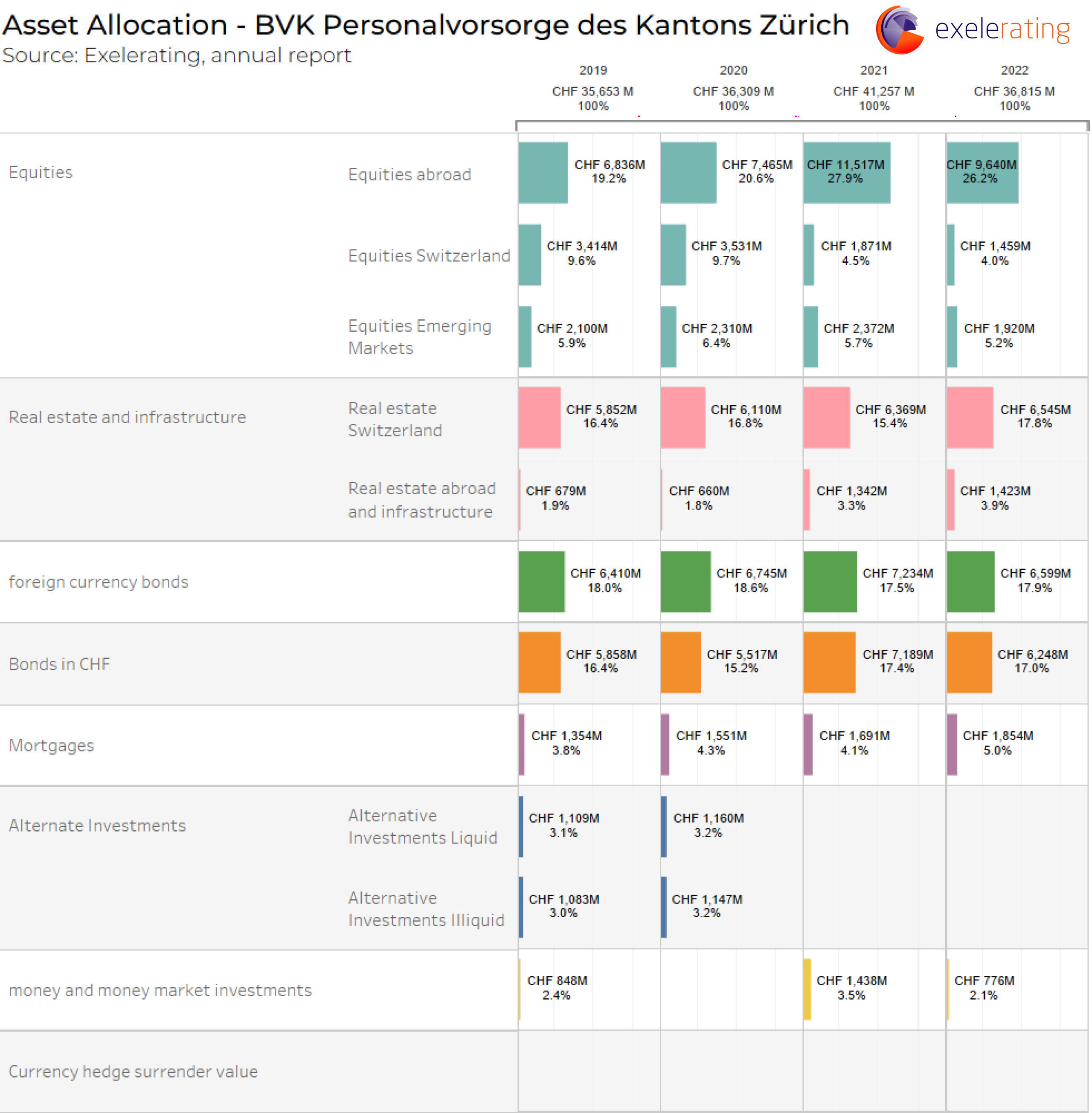

The BVK Personalvorsorge des Kantons Zürich is the third-largest pension fund in Switzerland, with CHF 36,82 billion in assets under management (AUM) as of December 2022.

BVK Personalvorsorge des Kantons Zürich is a pension fund that specifically caters to employees of the Canton of Zurich in Switzerland. It serves as the mandatory occupational pension plan for government employees within the canton.

BVK Personalvorsorge des Kantons Zürich has around 133,000 people insured. It invests in a diversified portfolio of assets, including Bonds in CHF, alternative investments and real estate and infrastructure. The pension fund has two investment advisors fulfilling different roles. Thomas Stucki is fulfilling the role of specialist for capital investments and Kurt Ritz fulfilling the role of specialist in real estate investments.

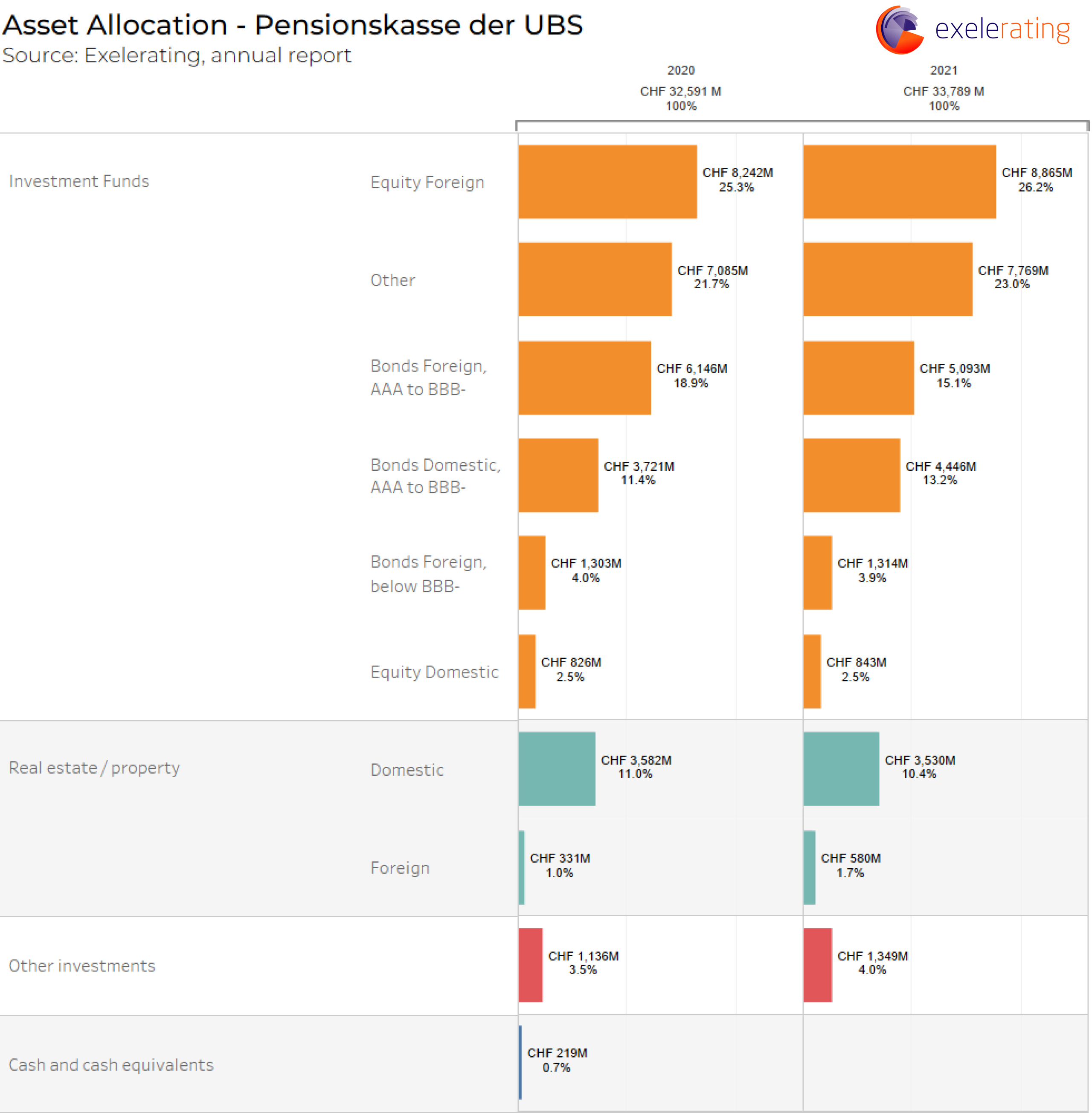

4. Pensionskasse der UBS – CHF 33.98 billion

Pensionskasse der UBS is the fourth-largest pension fund in Switzerland, with CHF 33.98 billion in assets under management (AUM) as of December 2021.

The Pensionskasse der UBS, also known as the UBS Pension Fund, is the pension scheme specific to UBS Group AG, a Swiss multinational investment bank and financial services company. The UBS Pension Fund operates as an occupational pension plan for UBS employees, providing retirement benefits to eligible participants.

Pensionskasse der UBS allocates their assets for instance to cash and equivalents, investment funds and real estate/property.

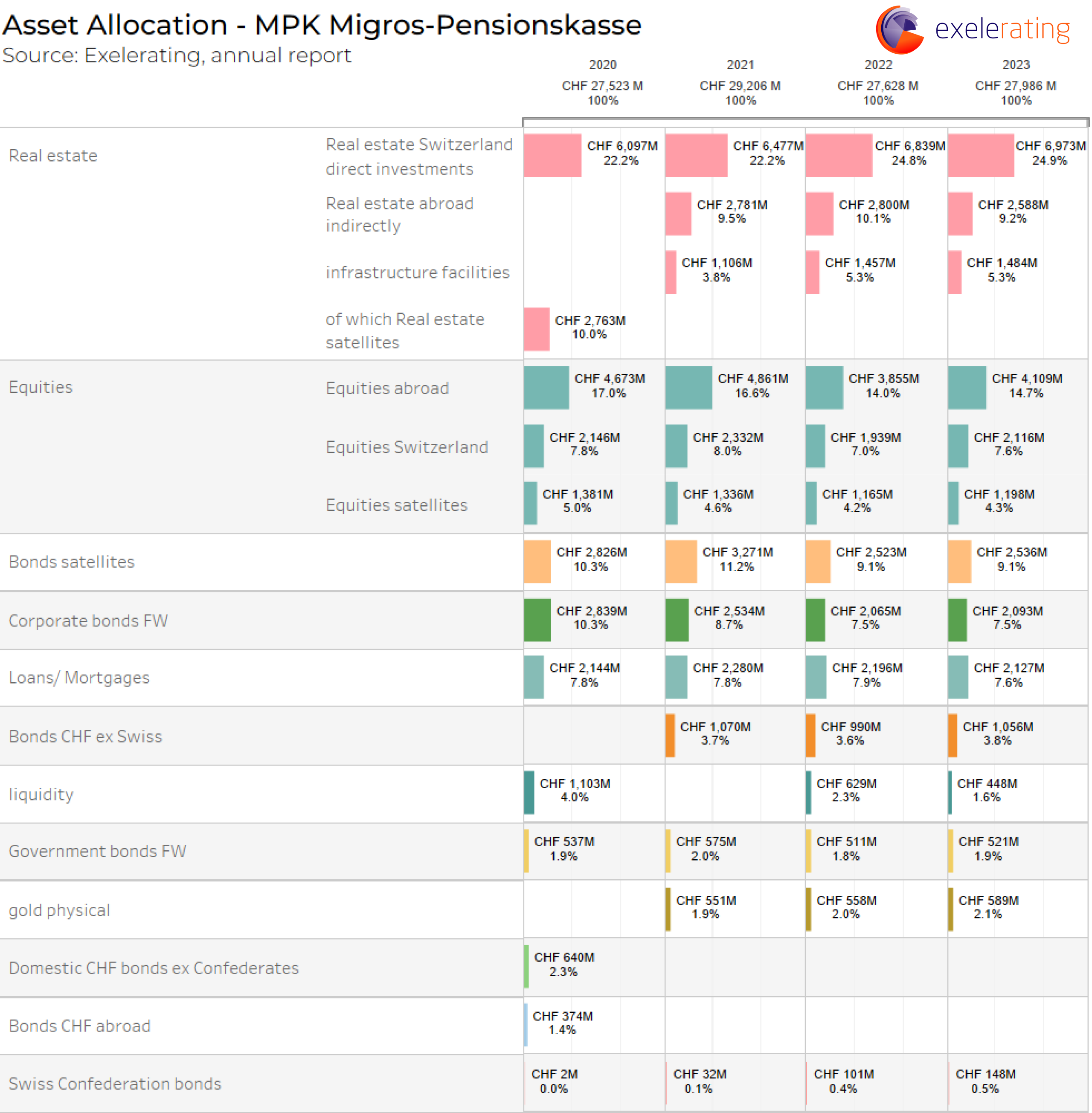

5. MPK Migros-Pensionskasse – CHF 27.99 billion

MPK Migros-Pensionskasse is the fifth-largest pension fund in Switzerland, with CHF 27.99 billion in assets under management (AUM) as of December 2022.

MPK Migros-Pensionskasse is the pension fund of Migros, which is one of the largest retail companies in Switzerland. It operates as an occupational pension plan specifically designed for employees of Migros and its affiliated companies. The fund has approximately 80,000 members and invests in assets like real estate, Loans/Mortgages, liquidity and Swiss confederation bonds.

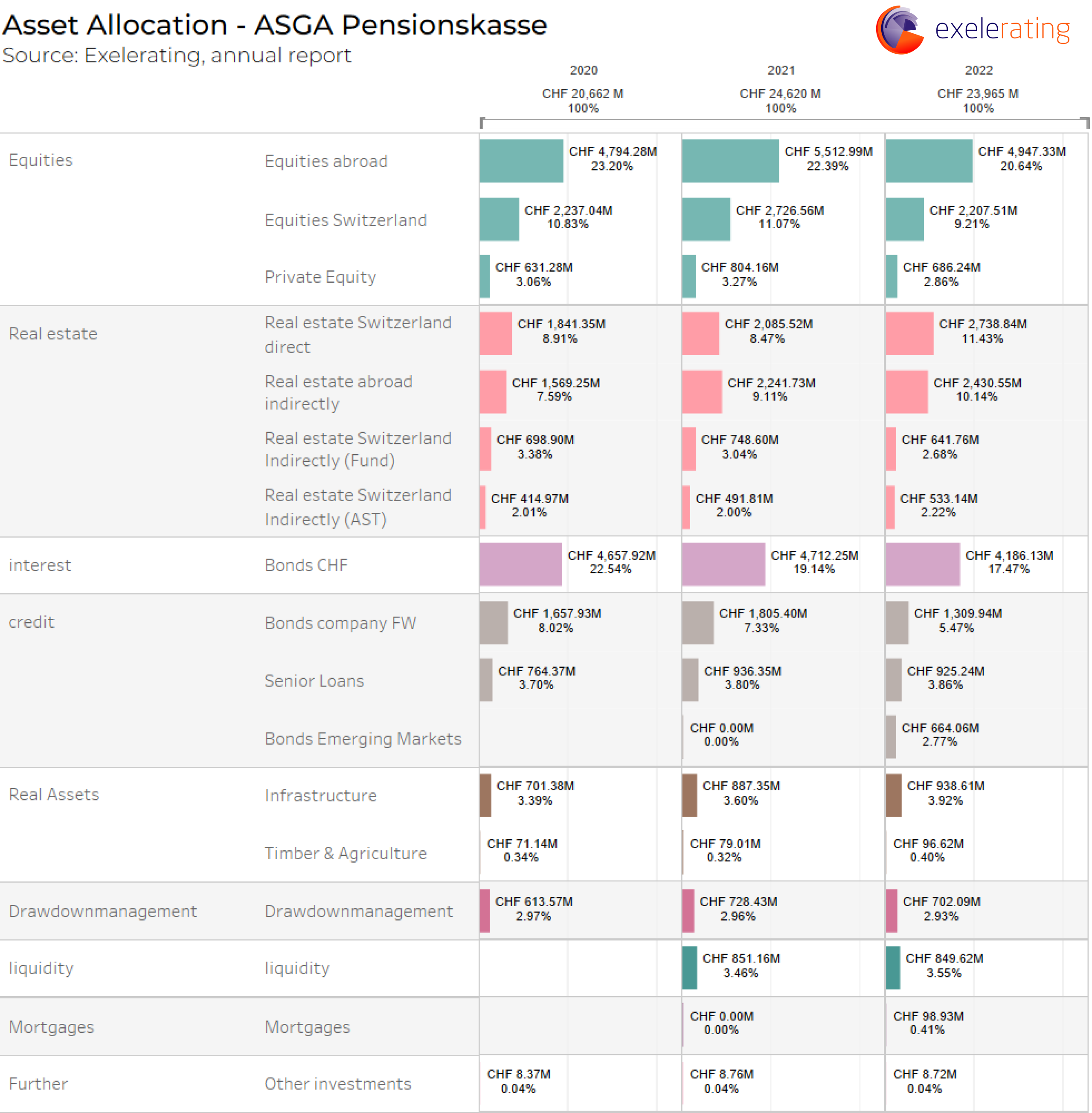

6. ASGA Pensionskasse – CHF 23.97 billion

ASGA Pensionskasse is the sixth-largest pension fund in Switzerland with CHF 23.97 billion in assets under management (AUM) as of December 2022.

ASGA Pensionskasse is a Swiss pension fund operating in the occupational pension sector (Berufliche Vorsorge). It is a multi-employer pension fund, which means it is open to multiple companies and their employees who choose to participate in the fund.

The fund has approximately 150,000 members and about 16,000 member firms. ASGA Pensionskasse has four investment advisors. Adrian Weibel and Marco Bagutti are two external investment advisors. Also, Bruno Schweinzer and Robert Hauri are two investment advisors working for Morgan Stanley. The fund invests in assets like liquidities, direct and indirect real estate and credits.

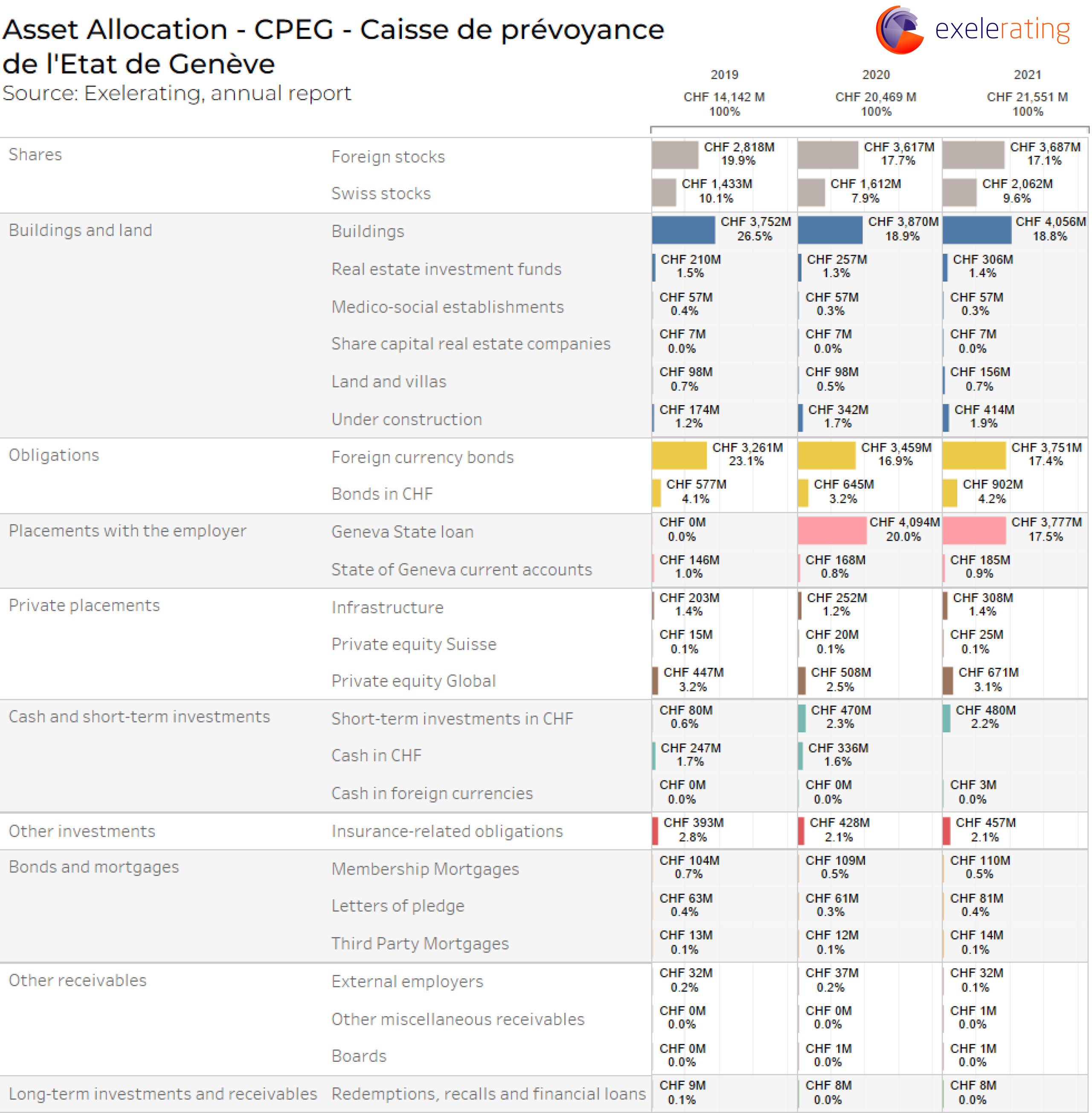

7. CPEG – Caisse de prévoyance de l’Etat de Genève – CHF 21.87 billion

CPEG – Caisse de prévoyance de l’Etat de Genève is the seventh-largest pension fund in Switzerland, with CHF 21.87 billion in assets under management (AUM) as of December 2021.

CPEG (Caisse de prévoyance de l’Etat de Genève) is the pension fund of the State of Geneva in Switzerland. It is a public sector pension fund specifically designed to provide retirement benefits to employees of the State of Geneva and its associated entities.

CPEG has around 79,000 members and has multiple investment advisors. The in 2021 known investment advisor with the function of financial advisor is the company PPCmetrics. The other in 2021 known investment advisors are MBS Capital Advice, Inrate- Sustainable Investment Solutions and Ethos. CPEG invests in assets like obligations, shares and real estate.

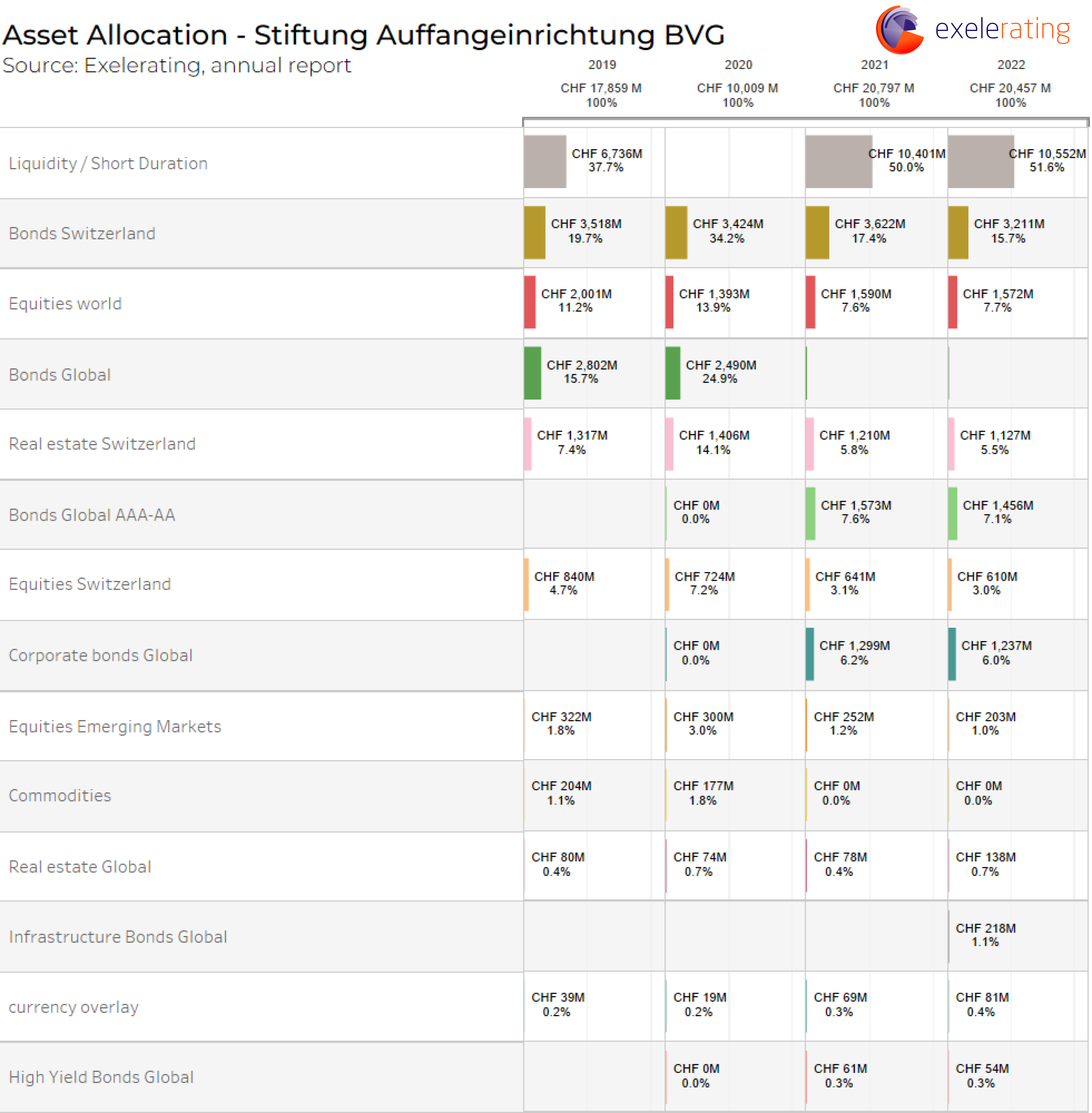

8. Stiftung Auffangeinrichtung BVG – CHF 20.46 billion

Stiftung Auffangeinrichtung BVG is the eight-largest pension fund in Switzerland, with CHF 20.46 billion in AUM as of December 2022.

Stiftung Auffangeinrichtung BVG, also known as the BVG Compensation Fund, is a pension fund in Switzerland. It is specifically established as a “compensation institution” or “safety net” for individuals who do not have mandatory occupational pension coverage or whose previous pension funds have been dissolved or become insolvent.

BVG Compensation Fund has around 1.5 million active insured persons and approximately 12,000 pensions paid. The fund invests in a portfolio of assets like commodities, equities Switzerland, equity emerging markets and corporate bonds global.

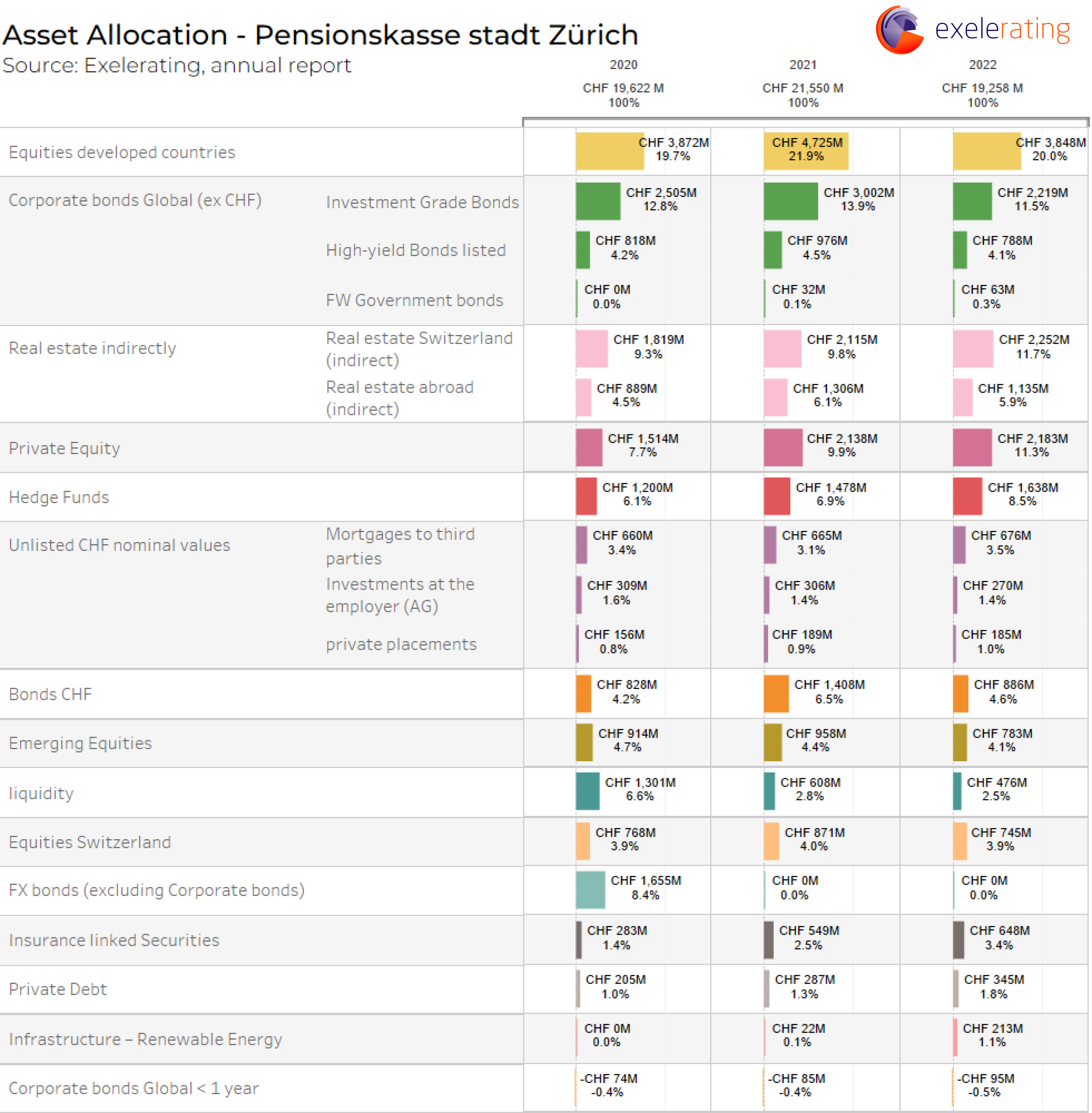

9. Pensionskasse stadt Zürich – CHF 19.26 billion

Pensionskasse Stadt Zürich is the ninth-largest pension fund in Switzerland, with CHF 19.26 billion in assets under management (AUM) as of December 2022.

Pensionskasse Stadt Zürich (PKZH), also known as the Pension Fund of the City of Zürich, is a pension fund specifically established to provide retirement benefits to employees of the City of Zürich in Switzerland. It is a public sector pension fund catering to the employees of the city administration, municipal institutions, and associated organizations.

PKZH has around 36.000 active members and has approximately 20,000 pensioners. More than 160 organisations are members of the fund. Pensionskasse Stadt Zürich has multiple investment advisors serving different functions. Cambridge Associates has the function of manager selection and monitoring. Portfolio Advisors is the private equity specialist North America. Peter Schwanitz of Raplh Aerni Advisory is the private market investment specialist. Raumentwicklung and Stefan Fahrländer of Fahrländer Partner Raumentwicklung (FPRE) hold the role of real estate expert advice. Adams Street Partners fulfill the role of specialist advice on European private-equity-anlagen, Reasonanz Capital are the specialist advice on hedge funds. ECOFIN has the role of strategy advice to the investment committee for general advice and for strategy controlling.

Pensionskasse Stadt Zürich allocates their assets for example to hedge funds, private equity, liquidities and private debt.

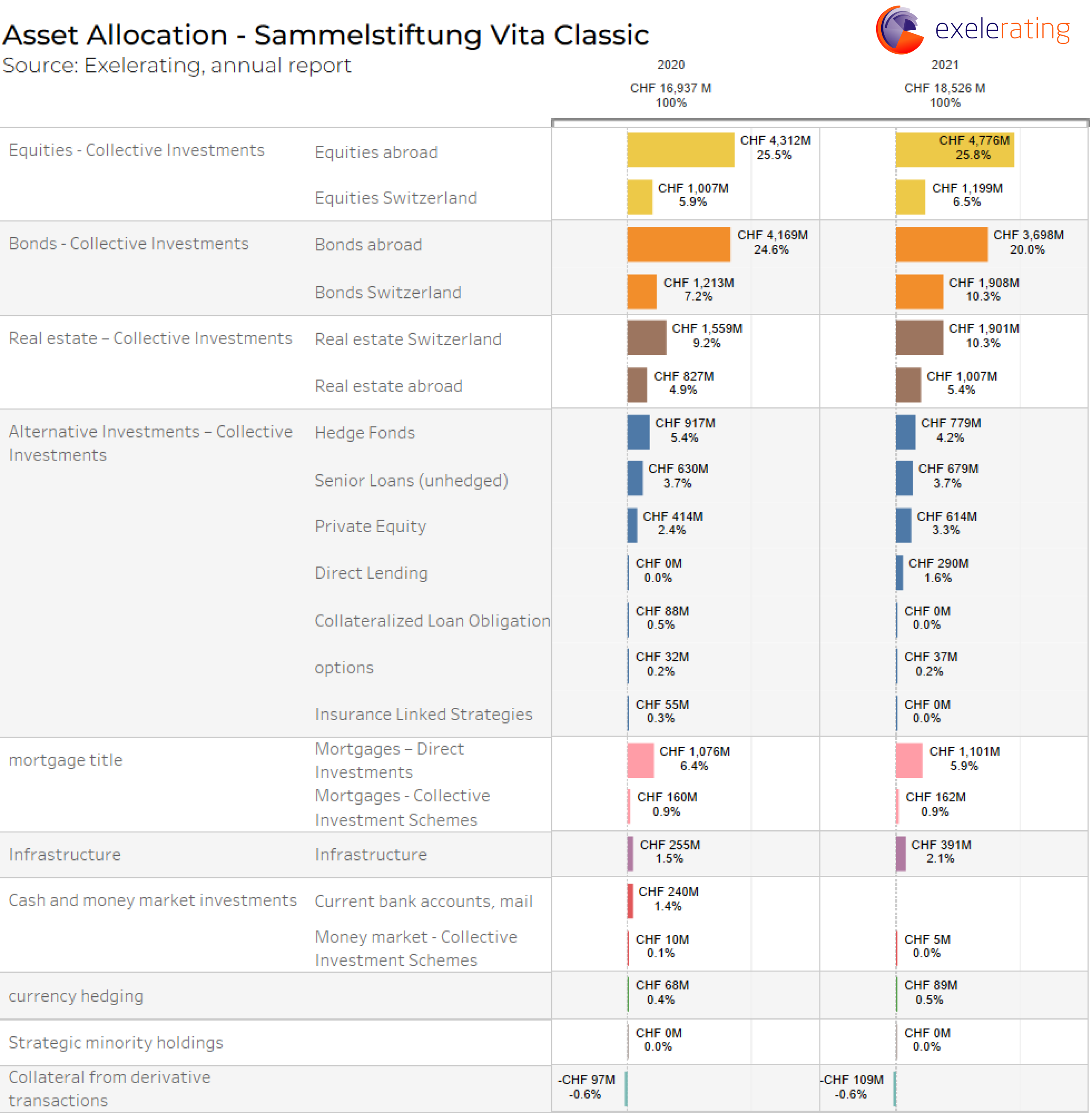

10. Sammelstiftung Vita Classic – CHF 18.73 billion

Sammelstiftung Vita Classic is the tenth-largest pension fund in Switzerland, with CHF 18.73 billion in assets under management (AUM) as of December 2021. Sammelstiftung Vita consists of 4 different pension funds: Classic, Invest, Plus and Select.

Sammelstiftung Vita Classic is a pension fund in Switzerland that operates as a collective foundation, also known as a collective occupational pension scheme (Sammelstiftung). It is designed to provide occupational pension benefits to employees of participating companies that have chosen to be members of the Vita Classic pension fund.

Vita Classic has multiple investment advisors fulfilling different roles. Zurich Invest has taken the roll of Market analyses and market outlook. C-alm has taken the roll of Various investment analyses as one of the two investment advisors. The fund invests in a portfolio of assets like bonds – collective investments, infrastructure and alternative investments