This article briefly examines the relationship between Swiss pension funds and their investments in (Swiss) real estate. It highlights the asset allocation of Swiss pension funds to real estate and provides an overview of which pension funds allocate the most pension capital to real estate. The last paragraph of the article gives some information about asset managers and mandates in the Swiss real estate world.

This article is based on public data sources from the Exelerating database. [1] Due to public availability, this study does not include all Swiss pension funds, but it covers 75% of assets under management held by Swiss pension funds.

Real Estate Allocation

In the Swiss institutional market, real estate plays a significant role within the investment portfolios of pension funds. The average allocation to real estate compared to the total portfolio is 27%, which is very high, especially compared to other countries with large pension assets such as the Netherlands and the UK. Dutch pension funds have an average allocation of 7.5% to real estate, compared to the total portfolio. In the UK that percentage is even lower, about 5.6%. [2]

The average allocation of 27%, based on annual reports 2022-12, may be high compared to other major pension countries, but Swiss legislation applies a quota of 30%. This means that real estate may not account for more than 30% of the total portfolio. In the reporting year 2022, there were dozens of pension funds that exceeded this percentage. If pension funds are reaching the limit of the quota, they have two options: wait out the time until the real estate allocation falls within the 30% requirement again or rebalance the portfolio.

Swiss Real Estate

Swiss national real estate plays a very dominant role within the real estate asset class. The ratio of national versus international real estate is 5:1. This way Swiss pension money flows directly back into the Swiss economy. The variety in real estate investments in Switzerland is high. In addition to indirect real estate, there is a lot of direct (Swiss) real estate, listed real estate, real estate investment funds, collective real estate investments and real estate investments through foundations, so called ‘Anlagestiftungen’.

Top 5 Swiss pension funds allocation to Real Estate

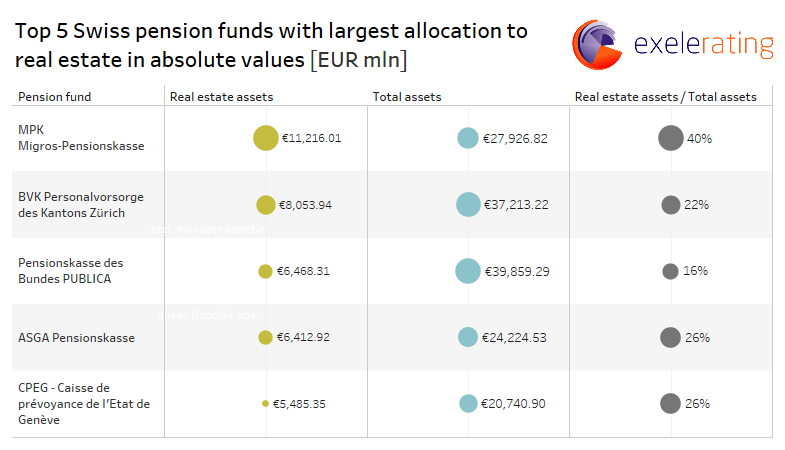

The table below includes the five Swiss pension funds with the largest exposure to real estate in absolute values.[3] These pension funds are among the 10 largest pension funds in Switzerland in terms of assets under management. In addition to the allocation in euros, the relative values have also been added.

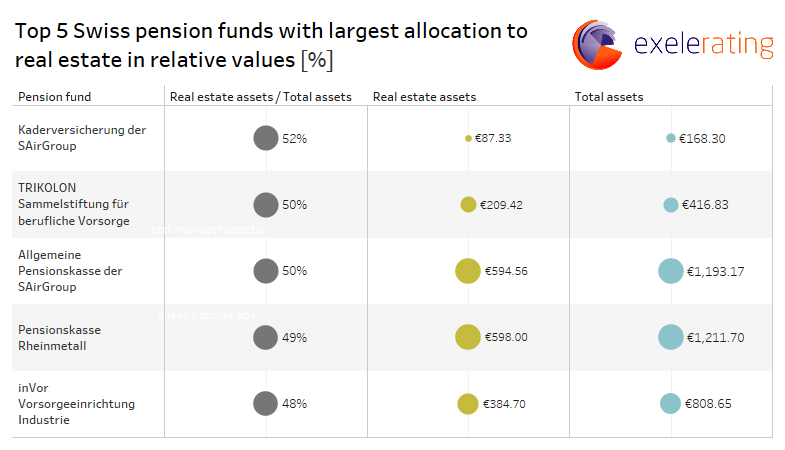

Table below shows the five Swiss pension funds with relatively the highest allocation to real estate. These funds belong to the smaller ones in terms of total assets under management but have the biggest – relative- allocation to real estate investments.

Real Estate Managers

We have examined 224 pension funds of which 92 have published information about their real estate manager. Based on these figures, Credit Suisse is the most often appointed real asset manager by Swiss pension funds. In second place there is UBS and Swiss Life completes the top 3.

Important to mention is that the acquisition of Credit Suisse by UBS is not included in these figures. The data is based on the 2022 annual reports. The acquisition of Credit Suisse by UBS will change this list. The ‘new’ UBS will be the dominant factor in the Swiss institutional real estate market.

Top 5 Real Estate managers appointed by Swiss pension funds:

- Credit Suisse

- UBS

- Swiss Life

- Swiss Prime Site

- Pensimo

Conclusion

It can be concluded that real estate has a significant share in the asset allocation of Swiss pension funds. Compared to other major pension countries, the differences are very large. Swiss regulations play an important role in this, but the need of Swiss people and institutions to invest in their own country also plays a role.

If you have any questions about the Swiss real estate market in relation to Swiss pension funds or the Swiss institutional pension market in general, please contact us. We are happy to help you.

You can request a demo using this link

—————————————————————————————————————————————————————-

[1] Annual reports, financial statements, websites.

[2] Based on asset allocations from public sources in the Exelerating database.

[3] As stated in the introduction the data is based on the Exelerating database which doesn’t cover all the Swiss pension funds known at the Swiss Federal Statistical Office. It is a subset.