The Nordic region boasts a collection of pension fund markets that are both substantial in size and noteworthy for their commitment to securing retirement benefits. With Sweden, Denmark, Finland, Norway and Iceland at the helm, the Nordic countries collectively hold a position of importance in the global pension landscape.

In this article the 10 largest pension funds in the Nordics will be examined with their asset allocation if known. But to give some nuance, we give a brief overview of the Nordics pension system. The overview is based on insights conducted by Nordic Co-Operation, a regional intergovernmental organization that facilitates collaboration and coordination among the Nordic countries.

Pension system Denmark

With a total assets under management of over €800 billion, Denmark’s pension fund market is relatively one of the biggest in the Nordics according to Exelerating’s database. In Denmark, the pension system offers various types of pensions to its residents. According to Nordic Co-operation the Danish pension system includes the following:

1. Statutory Pensions and Benefits: This category encompasses the Danish retirement pension (old-age pension), disability pension, and senior pension.

2. ATP Lifelong Pension: The ATP Lifelong Pension is a mandatory pension scheme that most individuals contribute to. Once you reach the retirement age, your pension is automatically paid out. In the event of your death, your spouse, partner, or children receive a lump sum from ATP.

3. Obligatory Pension: If you receive certain social benefits, such as unemployment benefit, parental benefit, or disability pension, the state pays pension contributions on your behalf.

4. Early Retirement Pension: The early retirement pension, known as “efterløn,” allows you to exit the labor market four years before reaching the official retirement age. Eligibility requirements for early retirement pension depend on your birthdate. To receive the pension, you must be a member of an unemployment insurance fund, have made early retirement contributions for 30 years, and initiated the payments no later than your 30th birthday.

5. Labour Market Pensions and Individual Pensions: Labour market pension schemes are negotiated through collective agreements for specific work areas. To learn about the pension schemes available at your workplace, consult your employer. Individual pensions are independent savings schemes that you establish with a bank or pension fund, separate from your employer. PensionsInfo, accessible with Danish NemID, offers an overview of Danish pension schemes. For specific inquiries, contact your pension fund or bank.

6. Self-Employed Individuals: Self-employed individuals have the right to retirement pension similar to others but do not have a labor market supplementary pension. They can choose whether to contribute to ATP Lifelong Pension.

Pension system Finland

According to Exelerating’s database Finland is smaller in size with a total assets under management of over €250 billion compared to other countries. Nordic Co-operation states that in Finland, there are two main types of pensions within the pension system: earnings-related pensions and national pensions.

1. Earnings-Related Pensions: These pensions are based on the income earned through work in Finland. Employers are required to insure their employees, while self-employed individuals must insure themselves with a pension provider. The contributions made by both employers and employees fund these pensions. The amount of pension received is calculated based on the individual’s earnings and the duration of their pension contributions. Earnings-related pensions can be received as old-age pensions, disability pensions, cash rehabilitation benefits, survivors’ pensions, partial old-age pensions, and years-of-service pensions.

2. National Pensions: National pensions are social security benefits that are residence-based rather than earnings-based. The eligibility and amount of national pension received depend on the individual’s insurance period, which is determined by their length of residence in Finland and other pension income they may receive. The Social Insurance Institution of Finland (Kela) administers national pensions.

Pension system Sweden

Sweden’s pension fund market showcases a total assets under management of over €550 billion according to Exelerating’s database. Nordic Co-operation states that the pension system in Sweden consists of three components:

1. Retirement pension from the Swedish Pensions Agency (Pensionsmyndigheten): This is the national retirement pension administered by the Swedish Pensions Agency. It includes the income pension and premium pension, both based on income. Additional components like the guaranteed pension, housing supplement, and personal income support may apply depending on factors such as birth year and income level. The retirement pension also provides a survivor’s pension to support close relatives in the event of a death.

2. Occupational pension from employers: Most individuals receive an occupational pension from their employer. The type of occupational pension depends on the sector and birth year. There are four major occupational pension agreements covering employees in different sectors. Individuals may have occupational pensions from various pension companies associated with their employers.

3. Private pension savings: Individuals can choose to set up private pension savings through banks or insurance companies. This is a voluntary saving scheme and offers flexibility in saving for retirement. Examples of private pension savings options include investment savings accounts (ISK) or endowment insurance policies. Additionally, paying off the mortgage on one’s property can also serve as a form of retirement savings.

Pension system Norway

Norway’s pension fund market, led by the impressive Norway Government Pension Fund Global, holding almost 90% of the Norwegian pension fund market total assets under management of over €1.3 trillion according to Exelerating’s database.

Nordic Co-operation stated that the Norwegian pension system comprises of three parts: retirement pension from the National Insurance Scheme (folketrygden), occupational pension or contractual early retirement pension (AFP) from employers, and private pension savings.

1. Retirement pension from the National Insurance Scheme (folketrygden): This part of the system provides a pension to individuals who have lived or worked in Norway for at least five years after the age of 16. It is based on contributions made to the national insurance system and ensures that eligible individuals receive a basic level of pension income from the government.

2. Occupational pension or contractual early retirement pension (AFP) from employers: This part of the system is based on the pension schemes offered by employers to their employees. All employees in both the public and private sectors in Norway are covered by an occupational pension scheme. The specific pension benefits received depend on the terms of employment and the pension scheme in place. The contractual early retirement pension (AFP) is an additional option available to employees whose employers have a collective agreement that includes AFP provisions. It allows for early retirement under certain conditions.

3. Private pension savings: In addition to the pensions provided by the National Insurance Scheme and employers, individuals can also save privately for their retirement. Private pension savings refer to personal savings and investments made by individuals to supplement their pension income. There are various savings products and options available for individuals to choose from, allowing them to set aside funds specifically for their retirement.

Pension system Iceland

The Icelandic pension system, although considered the smallest among the pension markets in the Nordics, plays an important role. According to Exelerating’s database, the Icelandic pension market has over €47 billion in assets under management. While none of the Icelandic pensions are listed in the top 10, it is crucial to acknowledge Iceland’s inclusion in the article. As such, it is worth highlighting the largest Icelandic pension fund at the end of the article to provide a comprehensive overview. According to Nordic Co-operation the Icelandic pension system is based on three main pillars: the social insurance system, employment pension funds, and supplementary pension savings:

1. Social Insurance System: The social insurance system in Iceland is a public pension system funded by taxes and covers all Icelandic citizens. Entitlement to benefits under this system is linked to residence in Iceland. The system provides various types of pensions and supplements, including:

• Old-age pension: Individuals typically start drawing the old-age pension at age 67. However, there is flexibility, and one can apply for a pension from the age of 65 under certain conditions, although the payment amount will be permanently reduced. It is also possible to postpone drawing the pension until age 80, with increased payments after age 67 according to an actuarial schedule.

• Disability pension: This pension is provided to individuals who have a disability that significantly impairs their work capacity.

• Rehabilitation pension: It supports individuals who are unable to work due to illness or disability but have the potential to regain their work capacity through rehabilitation measures.

• Children’s pension: It is paid to children who have lost one or both parents.

• Spouse’s pension: It provides support to the surviving spouse or partner of a deceased pensioner.

The social insurance system also offers supplementary payments, such as a household allowance, vehicle allowance for those with mobility impairments, and specific expense reimbursements for medical and care-related costs.

2. Employment Pension Funds: All individuals working in Iceland are required to contribute to a pension fund. These funds are based on workers’ cumulative contributions and are managed by various pension funds. The pension funds offer retirement benefits, including old-age pensions, disability pensions, spouses’ pensions, and children’s pensions. The pension payments usually begin at age 67, but some funds may offer benefits starting from age 65. If individuals move to other Nordic countries, the pension payments are generally transferred, but it is advisable to contact the specific pension fund for confirmation.

3. Supplementary Pension Savings: Supplementary pension savings are voluntary savings made by individuals in addition to their mandatory pension contributions. Individuals can contribute between 2% and 4% of their salary, and employers match their contributions. These savings serve as private property and provide additional benefits beyond the mandatory pension savings. Payment from supplementary pension savings can begin at the age of 60 or later and is typically paid in equal installments until age 67 or longer. Upon the death of a pensioner, supplementary pension savings are inherited according to the rules of the Inheritance Act.

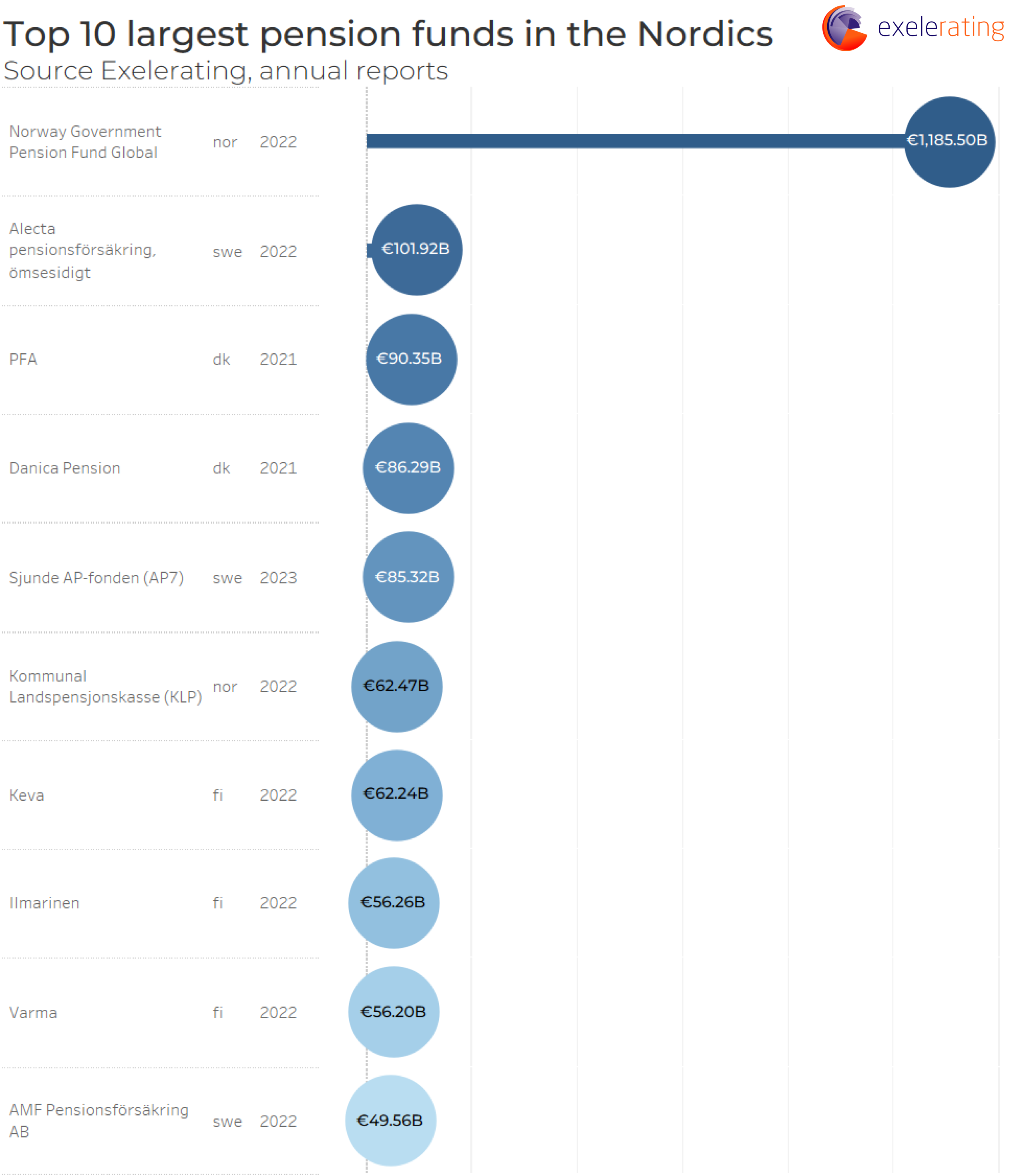

Top 10 largest pension funds

1. Norway Government Pension Fund Global – €1,185.50 billion

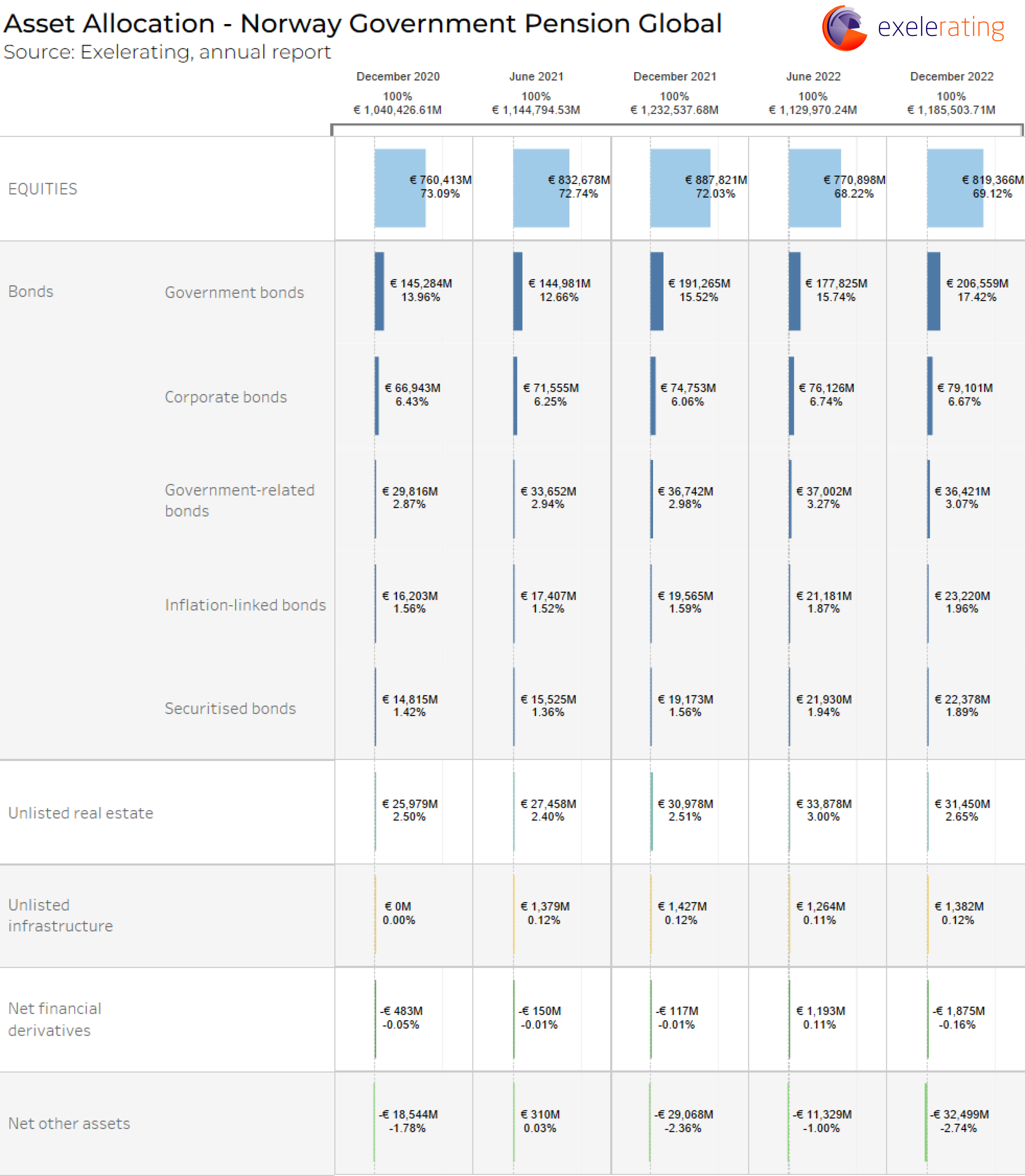

The Norway Government Pension Fund Global (often referred to as the Norwegian Sovereign Wealth Fund) is a pension fund established by the Norwegian government and managed by the Norges Bank. It is one of the largest sovereign wealth funds globally, with significant assets under management amounting to €1,185.50 billion as of December 2022.

The establishment of the Government Pension Fund Global was supported by legislation passed in 1990, with the first deposits made into the fund in 1996. As the name suggests, the fund is exclusively invested abroad, aiming to diversify investments and reduce dependency on domestic economic conditions. Its primary objective is to ensure responsible use of oil revenue and secure the future of the Norwegian economy.

It holds a diversified portfolio of investments across various asset classes and geographies. The fund has investments in over 9,000 companies worldwide. On average, it holds a 1.5 percent stake in all listed companies globally.

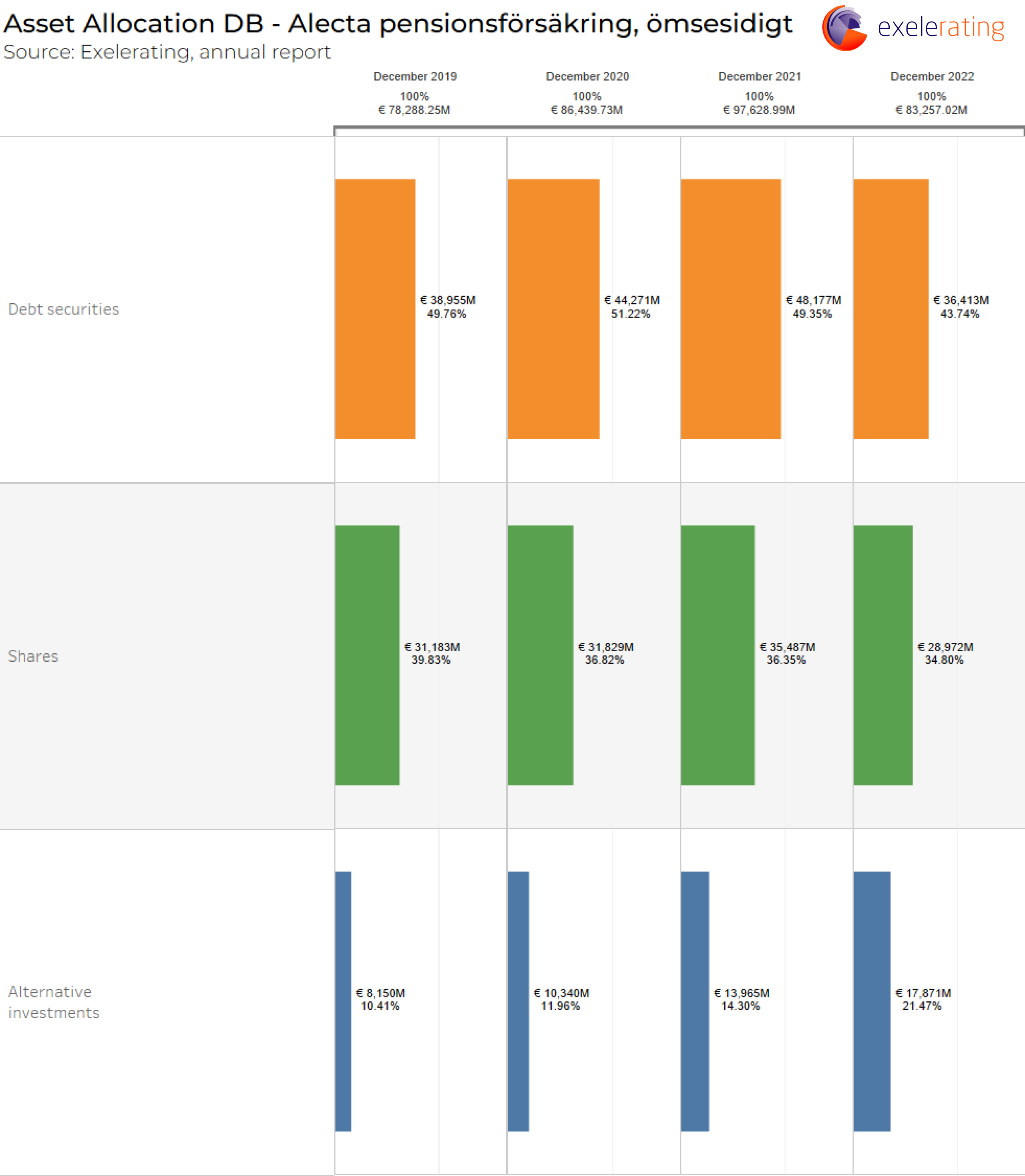

2. Alecta pensionsförsäkring, ömsesidigt – €101.92 billion

Alecta Pensionsförsäkring, ömsesidigt is a prominent pension fund based in Sweden. Established in 1917, it has a significant presence in the Swedish pension market. Alecta is owned by 2.6 million private customers and 35,000 corporate customers, making it a collective organization that serves a large number of individuals and businesses.

A notable characteristic of Alecta is its focus on collectively agreed occupational pensions, particularly the ITP (Individual Pension Agreement) system. Alecta manages all ITP2 pensions, which are defined benefit occupational pensions. These pensions provide a specified level of retirement benefits based on factors such as salary and years of service. Alecta is the default option for ITP 1 and TPK, which are defined contribution occupational pensions. These pensions are based on contributions made by both employees and employers, with the final retirement benefit dependent on the investment performance of the pension funds.

With approximately €101.92 billion in assets under management as of December 2022, Alecta is one of the largest investors on the Stockholm Stock Exchange. It holds a portfolio of investments in various asset classes, including shares and alternative investments. In fact, Alecta is one of the largest property owners in Sweden.

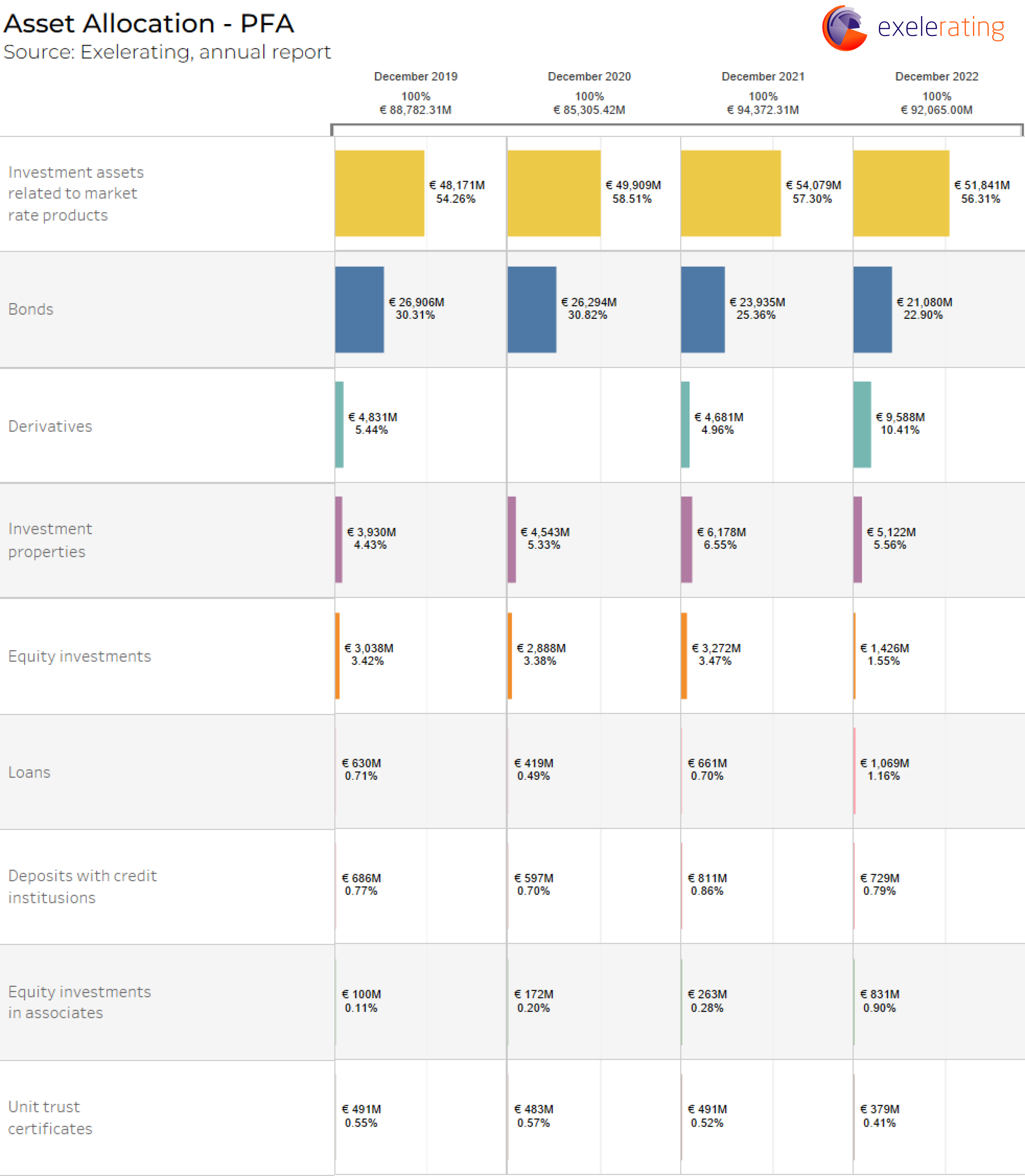

3. PFA – €90.35 billion

PFA is a Danish pension fund that serves a wide range of individuals and organizations in Denmark. It caters to approximately 1.3 million customers. The fund provides comprehensive pension solutions, ensuring financial security and retirement benefits for its members. As a prominent player in the Danish pension market, PFA manages a substantial amount of assets under management, totaling around €90.35 billion as of December 2021.

PFA serves a broad range of customers in Denmark. Its client base includes both private individuals and corporate clients. Private individuals who are residents of Denmark can become members of PFA and participate in its pension schemes. This includes employees from various sectors and industries, self-employed individuals, and other individuals who wish to secure their retirement income through PFA’s pension products and services.

4. Danica Pension – €86.29 billion

Danica Pension is a prominent pension fund that operates in Denmark. With approximately 800,000 customers, it is a well-established provider of pension schemes, life insurance policies, and health insurance covers. The fund manages a substantial amount of assets, with a total assets under management of €86.29 billion as of December 2021, and receives annual contributions amounting to DKK 37 billion or approximately €4.7 billion.

As a pension fund, Danica Pension caters to individuals and organizations seeking retirement planning solutions and insurance coverage. It offers a range of pension products and services designed to help customers secure their financial future during their retirement years. Additionally, the fund provides life insurance policies to offer protection and financial security to individuals and their families in the event of unforeseen circumstances.

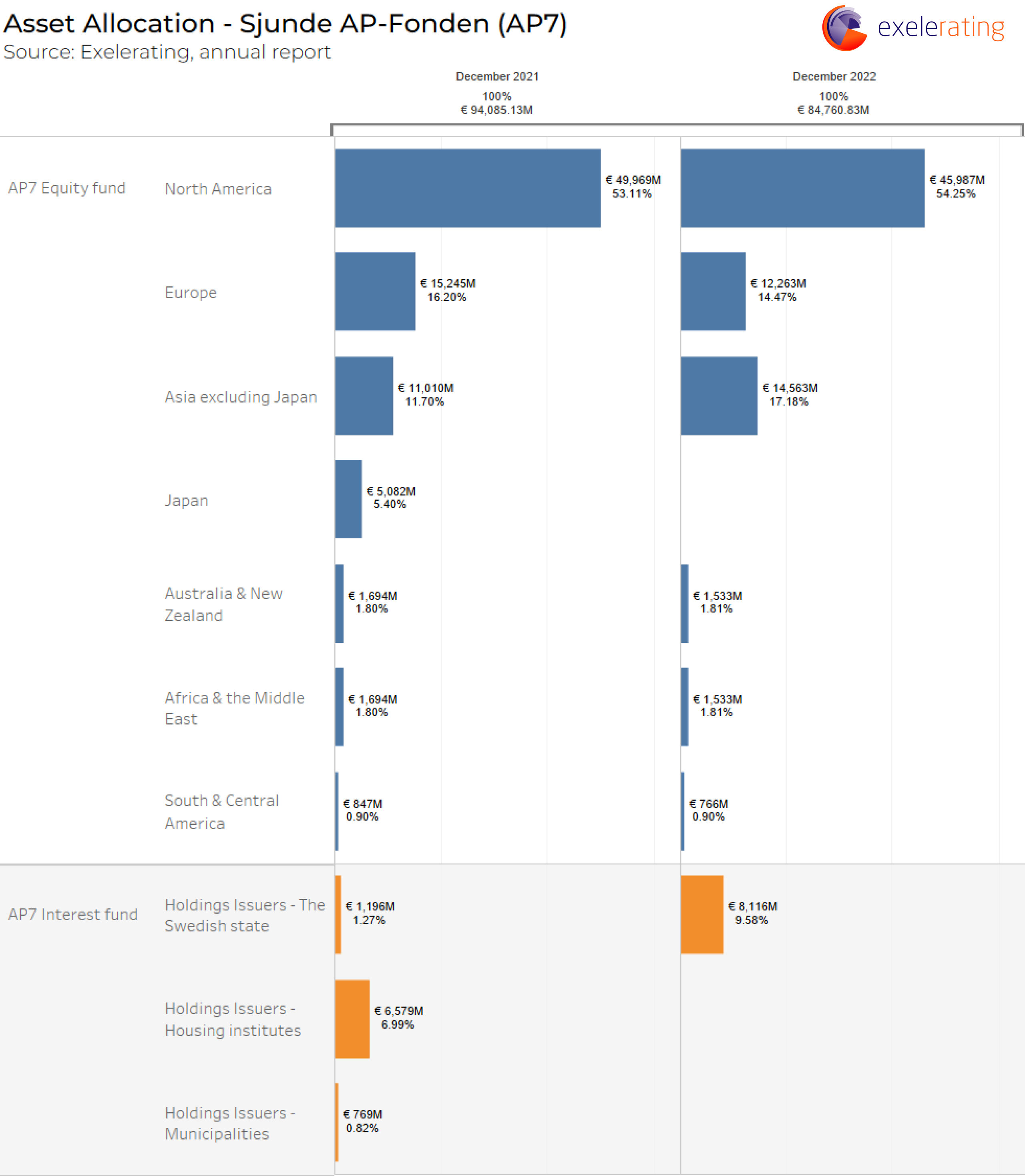

5. Sjunde AP-fonden (AP7) – €85.32 billion

Sjunde AP-fonden (AP7) is the fith largest pension fund in the Nordics with over €85.32 billion in assets under management. The fund is a government agency in Sweden that operates as a pension fund. It manages pension funds specifically for individuals participating in the Swedish premium pension system. The premium pension system allows individuals to choose how their pension funds are invested.

AP7’s primary role is to provide a default investment option for premium pension savers. This means that if individuals do not actively choose another investment alternative, their pension funds are automatically assigned to AP7.

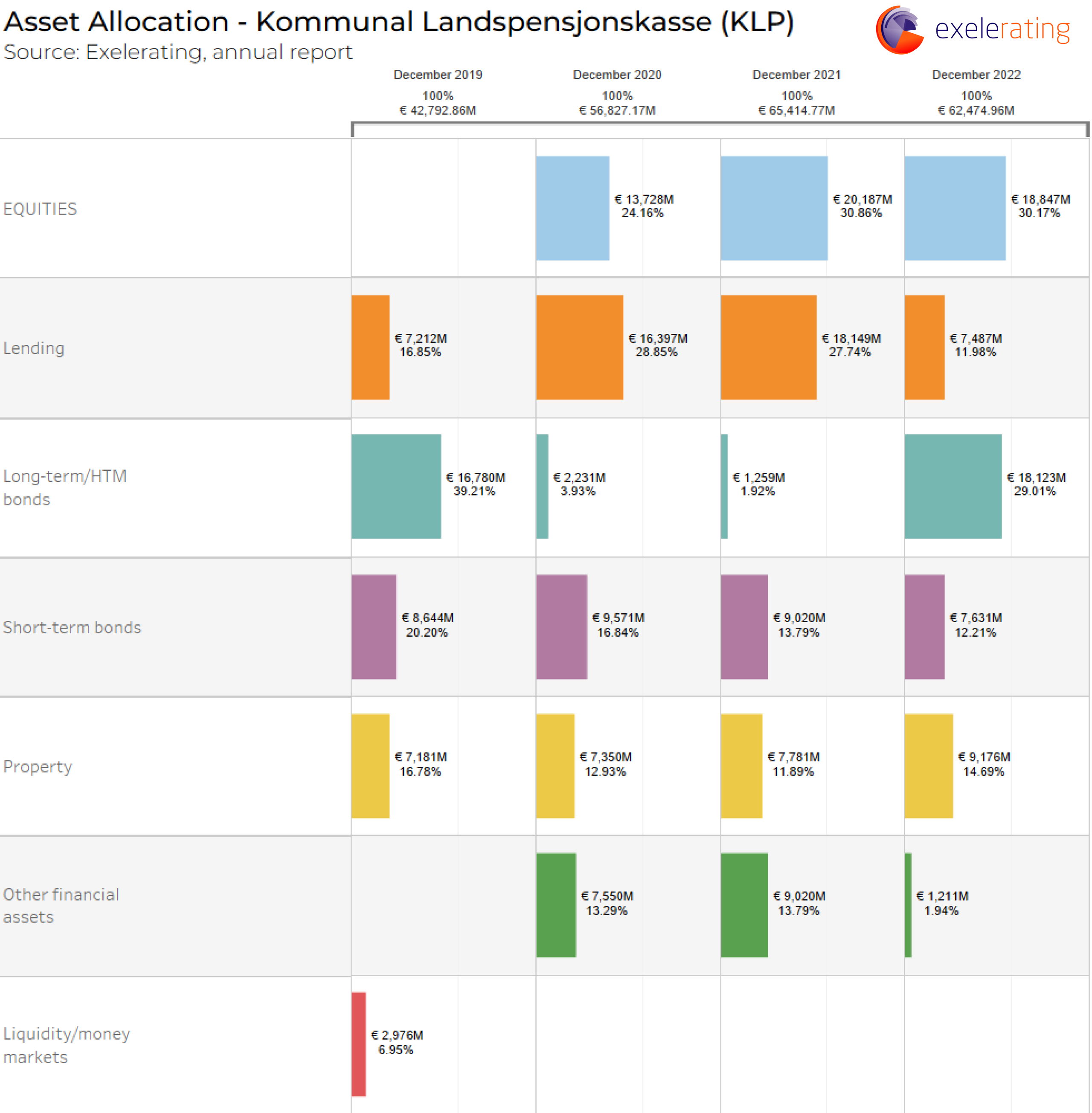

6. Kommunal Landspensjonskasse (KLP) – €62.47 billion

Kommunal Landspensjonskasse (KLP) is a Norwegian public sector occupational pension fund. It is one of the largest pension funds in Norway, managing assets on behalf of local municipalities, county authorities, and other public sector entities in Norway. KLP provides pension and insurance services primarily to employees in the public sector, including teachers, healthcare workers, municipal employees, and others employed by public institutions.

With €62.47 billion in assets under management as of December 2022, KLP plays a crucial role in ensuring retirement benefits for public sector employees in Norway.

7. Keva – €62.24 billion

Keva is Finland’s largest pension provider, serving as the pension fund for various entities in the public sector. The fund administers the pensions of employees from local government organizations, the State, the Evangelical Lutheran Church, Kela (the Social Insurance Institution of Finland), the Bank of Finland, and the new wellbeing services counties employees.

The fund’s significant assets under management of €62.24 billion as of December 2022 allows it to effectively manage and invest pension funds’ assets to ensure the financial security and well-being of its members upon retirement.

Keva serves the needs of approximately 1.3 million public sector employees and pensioners. Additionally, Keva serves around 2,000 employer customers, which include local government organizations, State employers, and parish unions.

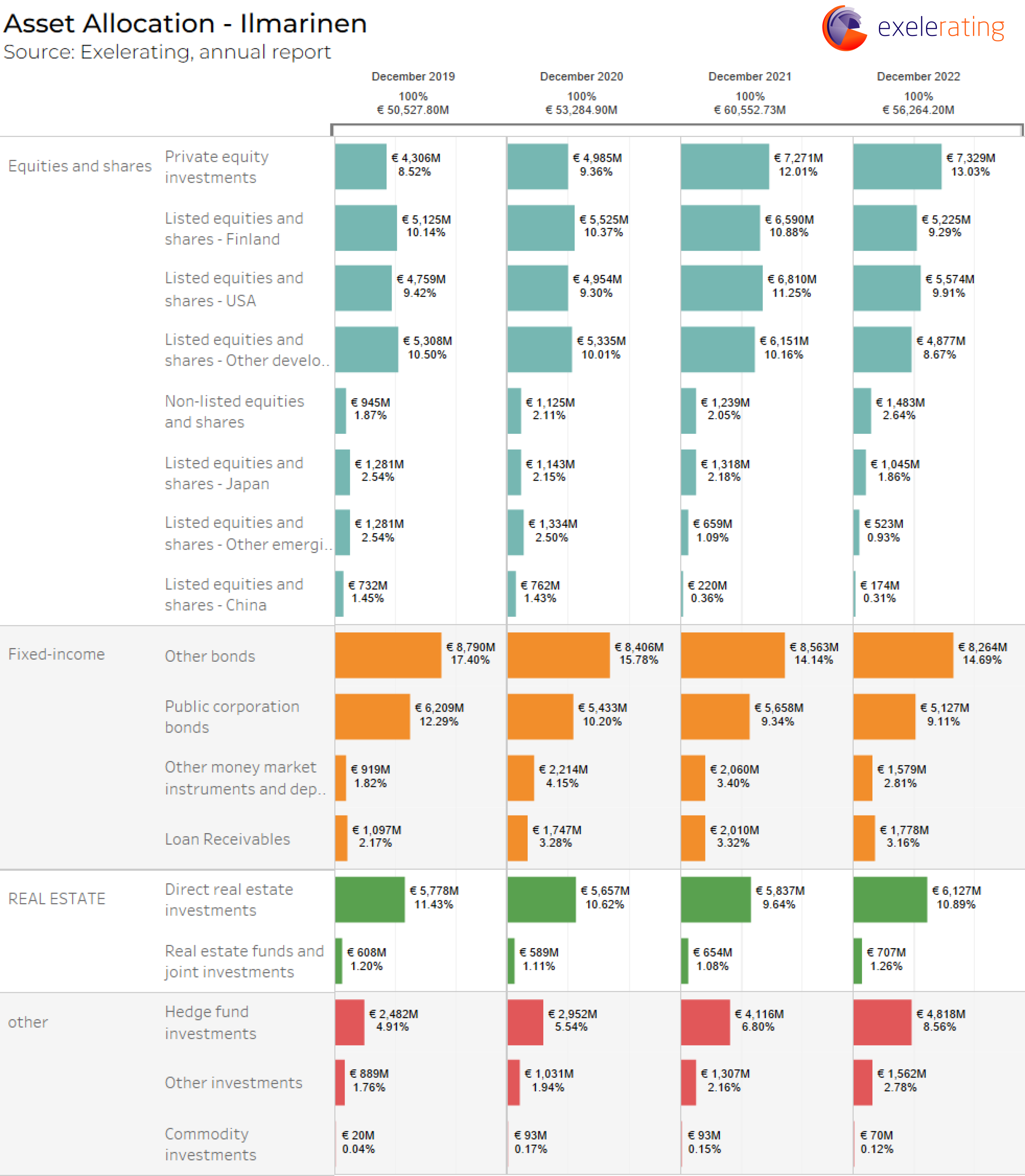

8. Ilmarinen – €56.26 billion

Ilmarinen is a Finnish pension insurance company and pension fund. It operates as a mutual company, providing pension insurance and managing pension assets. Ilmarinen primarily serves as a statutory earnings-related pension provider in Finland.

As of December 2022, Ilmarinen had €56.26 billion in assets under management. The fund caters to both private and public sector employees in Finland. It covers various industries and occupations, including employees in the private sector, self-employed individuals, and farmers.

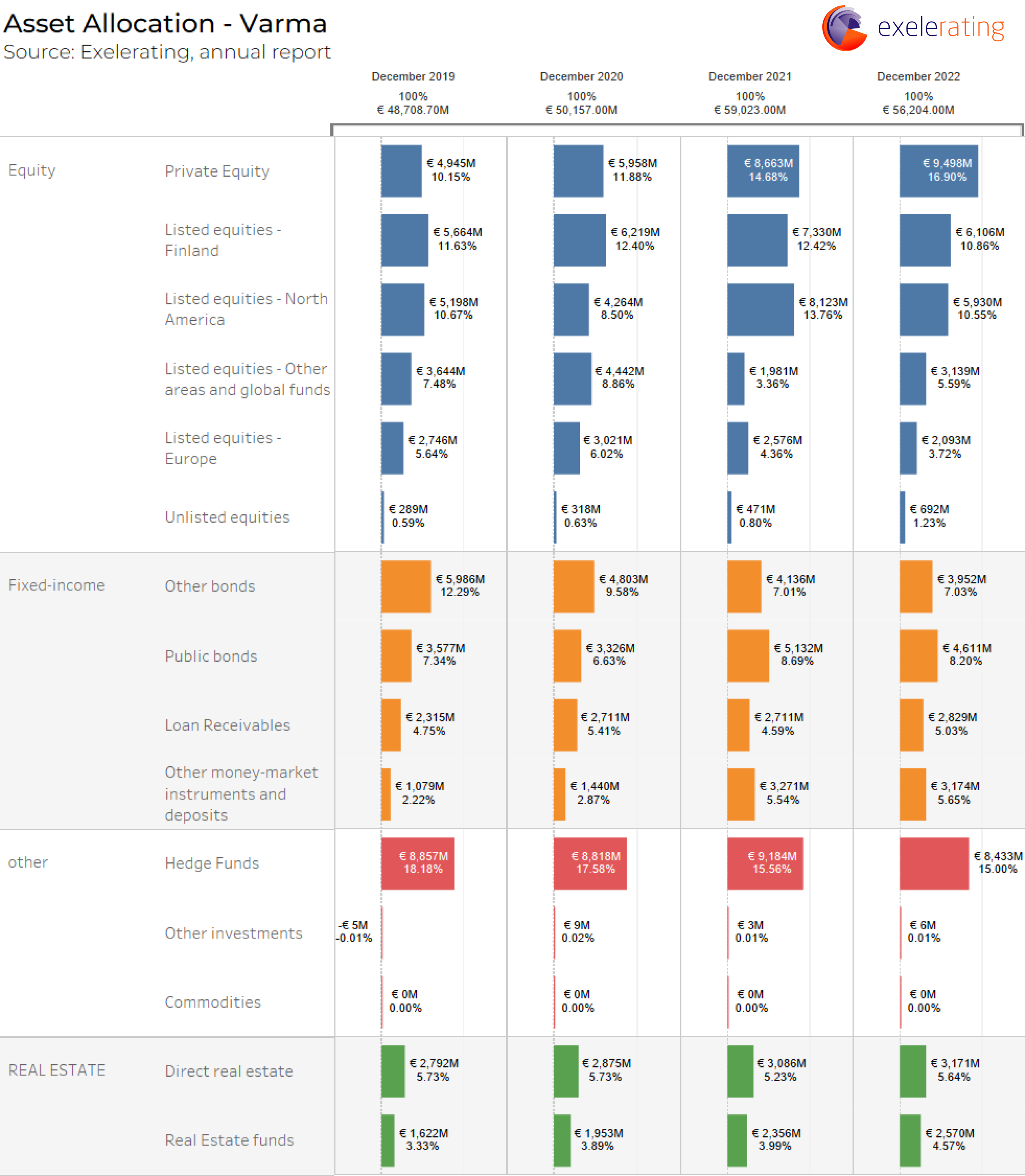

9. Varma – €56.20 billion

Varma is a private earnings-related pension insurance company in Finland. The fund is responsible for managing the statutory pension cover of private entrepreneurs and employees in the country. Private companies enroll their employees in the TyEL insurance, while entrepreneurs secure their own pension coverage through the YEL insurance.

With an assets under management of €56.20 billion as of December 2022, Varma plays a crucial role in ensuring the financial security and well-being of its members. The fund provides pension cover for over 900,000 individuals, including employees, entrepreneurs, and pensioners. Varma invests in assets like equity, fixed-income and real estate.

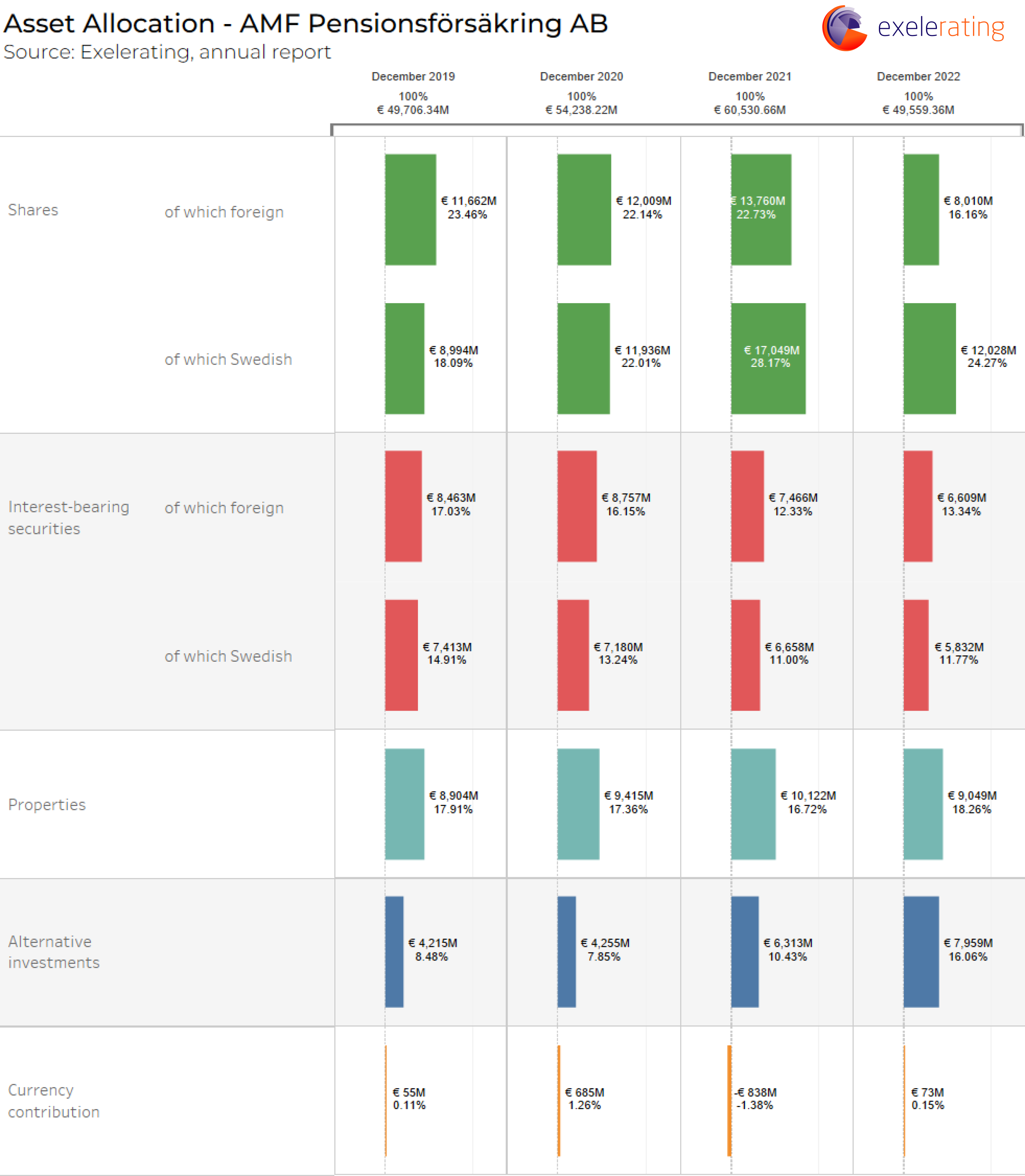

10. AMF Pensionsförsäkring AB – €49.56 billion

AMF Pensionsförsäkring AB is a pension fund that operates in Sweden. It is owned by two organizations, LO (Landsorganisationen i Sverige) and Svenskt Näringsliv. AMF is structured as a mutual organization, which means that its profits are reinvested for the benefit of its customers.

AMF manages a significant amount of assets, with approximately €49.56 billion assets under management as of December 2022. This makes it one of the largest pension funds in Sweden. AMF invests in asset classes like Swedish and foreign shares, properties and alternative investments. The fund primarily focuses on providing pension services and products, including occupational pensions, to its roughly 4 million customers.

The AMF Group consists of AMF Tjänstepension, which is responsible for managing the pension funds, and its subsidiaries AMF Fonder and AMF Fastigheter. AMF Fonder is involved in managing investment funds, while AMF Fastigheter deals with real estate investments. AMF is recognized as the third-largest active owner on the Stockholm Stock Exchange, indicating its influence and involvement in the Swedish financial sector.

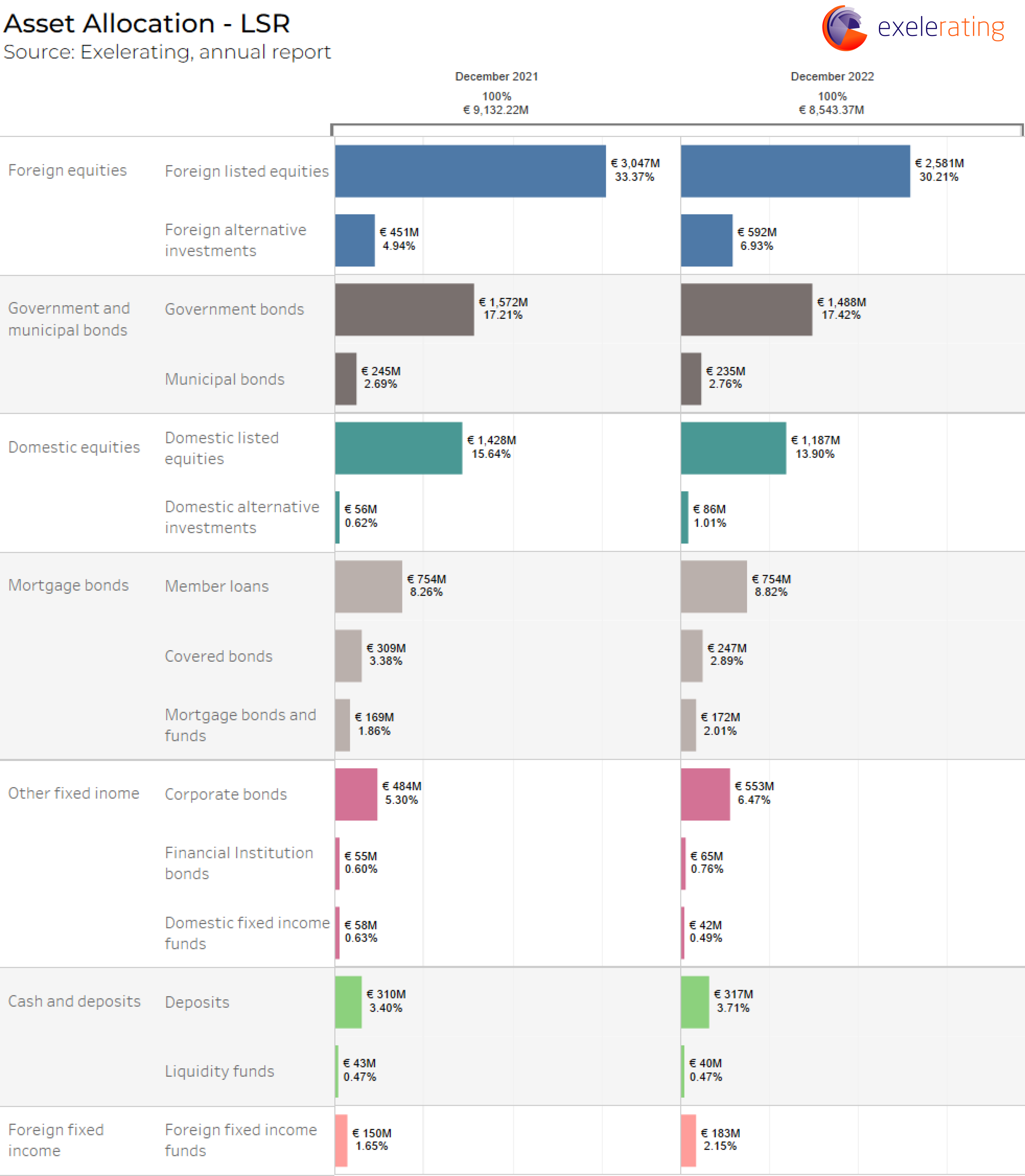

Lífeyrissjóður starfsmanna ríkisins (LSR) – €8.54 billion

Lífeyrissjóður starfsmanna ríkisins (LSR), also known as the Pension Fund for State Employees, is the largest pension funds in Iceland. As of December 2022, LSR has over €8.54 billion in assets under management. It is a mandatory occupational pension fund that provides retirement benefits to employees of the Icelandic government and related public sector entities.

LSR manages the pension savings of state employees and is responsible for administering and distributing pension benefits to its members upon retirement. The fund’s primary objective is to ensure the financial security of its members during their retirement years.

As an occupational pension fund, LSR operates within the second pillar of the Icelandic pension system, which focuses on employment-related pensions. It works in conjunction with the social insurance system and supplementary pension savings to provide comprehensive retirement benefits to eligible participants.